Address

Walnut Court

Wokingham

RG40 1XU

England UK

About Davon Ltd

Founded in 1996 and boasting over 25+ years of experience in the mezzanine finance sector and property development finance, Davon Ltd can provide the support that you need for your property development project. Whether you are looking to finance a ground up new build development project or want to refurbish a property for onward sale or to retain as an investment, we can provide the right finance solution.

Property Development Finance Lender for Property Developments in Berkshire, London and UK

Davon Ltd is an industry renowned and recognised property development finance lender based in Wokingham, Berkshire. Servicing the property development sector across the south of England. We understand the critical importance of finance in property development. That is why we pride ourselves on being a fast, reliable, and straightforward lending organisation that has the professionalism and resources to serve you and your finance requirements.

For over 25 years we have provided 2nd charge residential development finance to small to mid sized house builders and developers. We pride our selves on the fact that our funding has contributed to the development of 1000s of new and refurbished properties from apartments to large detached houses over the years. Having established the business in Wokingham, Berkshire in 1996, we now see an array of clients and projects across the south of England. We pride ourselves in being able to provide funding for our clients promptly to ensure property development can proceed in a timely manner. If you’re looking for a mezzanine loan for your property development, or need support in the market, Davon Ltd has a wealth of expertise in this sector and the property development mezzanine financing options to ensure your development can take shape. Davon specialises in providing development finance for residential developments in the UK, with a particular focus on the south of England, with schemes from Cornwall to Norfolk. With all our tools to hand, we can provide the extra level of funding that your property development project needs.

MEZZANINE FINANCE

Are you based in the south of England and looking to expand your property development activities or perhaps looking to leverage an opportunity in another scheme but the equity isn’t currently available? With mezzanine finance, an opportunity-rich developer can take the opportunity to spread their limited equity across a greater number of diverse portfolios of property development schemes.

CASE STUDIES

With over 25 years’ experience, we have funded a considerable number of property development projects across Berkshire and the UK. Have a look at some examples of the types of projects that we can fund. We are an industry leader when it comes to providing mezzanine property development loans and offer our clients the support, guidance and help they need to secure the right funding for their development.

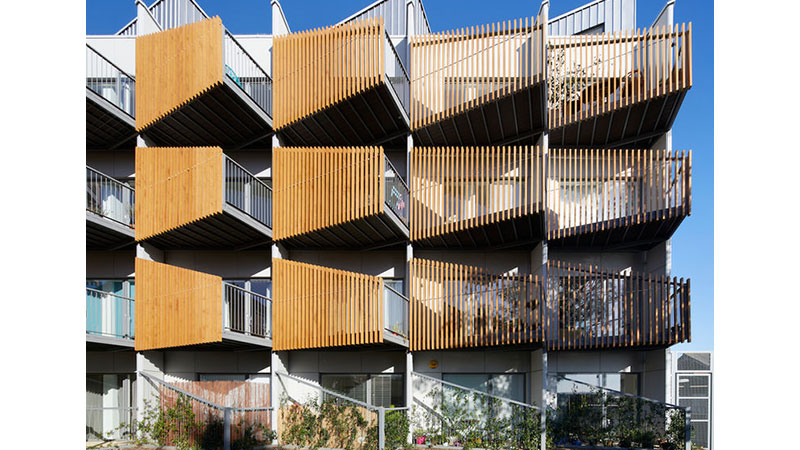

Gallery

News

By David Norman, Davon

For smaller and medium-sized developers, 2023 was the year that everything took longer. It took longer to find and acquire land, longer to obtain bank funding and longer to get materials delivered but most of all, it took longer to get planning permission.

There was barely a day all year when I didn’t have a discussion with a client involving planning. The industry’s frustration with the ponderous UK system is palpable.

It’s particularly galling for the SME residential developers who are typically our clients because they have fewer resources to deal with the bureaucracy and face more intense financial pressures than the big hitters, notably on cashflow. When you are stretched on a project having shelled out for a parcel of land, planning delays pile up your bank interest. Time is money.

And it is not just delays that eat cash. Even a small development of, say, two houses can incur upfront costs of £30-50,000 in planning and professional fees. For more complex projects, that number can easily top £100,000 when you factor in consultancy fees for a broader raft of planning hurdles such as right to light and environmental studies. Another big-ticket pre-planning bill can be option fees for the landowner.

Unfortunately for developers, banks dislike lending against developments pending planning applications as there are no assets in the project, which means the developer must find the cash.

These pressures have had a cataclysmic effect on smaller to medium residential developers.

According to the Federation of Master Builders, 40 years ago SME house builders delivered 40% of our homes. Today, this figure is just 12%.

Planning is not the only culprit. The FMB says the sector has been hit hard by successive recessions. They report that SME and custom builders say they struggle to access finance and land, but right up there on their list of complaints is the difficulty of navigating Britain’s complex planning system.

Our experience at Davon talking to SME residential developers throughout last year bore that out, so we were pleased to give our support to the FMB’s campaign for:

• A simplified planning system

• Making more small sites available for SME developers

• Investing in local authority planning departments to speed up the planning process

For years, successive governments have promised action to tackle the housing shortage and streamline the planning system. Yet the industry sees little or no progress and has become at least sceptical if not cynical.

The latest government initiative is the Levelling Up and Regeneration Act which became law in October 2023. It is supposed to speed up the planning system, hold developers to account, cut bureaucracy, and encourage more councils to put in place plans to enable the building of new homes.

The Act promises that new developments will be more attractive with better infrastructure such as GP surgeries, schools and transport links. Development will be shaped by local people’s democratic wishes, enhance the environment and create neighbourhoods where people want to live and work.

That all sounds great, but will it happen?

One feature of the Act that caught my eye is to give councils the power to work directly with landlords to bring empty buildings back into use by local businesses and community groups, “breathing life back into empty high streets”.

Many people in the property and construction world will tell you that converting offices and retail premises into residential is fraught with difficulty, but it can be done successfully.

Take our client, Barker Homes for example. We have provided mezzanine finance for a series of their conversion projects, the latest being a £10.5 million redevelopment to transform a town centre commercial building in Hemel Hempstead into 40 luxury apartments.

If planning policy changes can smooth the path for more of these and other kinds of conversion of redundant buildings, that would be welcome.

It will be necessary if the Act is to deliver on its objectives, which include directing growth to support the regeneration of brownfield sites and renewing and levelling up towns and cities with more homes in Britain’s largest urban centres including in the North and Midlands.

The government says that this will not only make the most of brownfield land but also maximise the use of existing infrastructure, taking advantage of structural change in urban land use and reducing the need for unnecessary travel.

One criticism we often hear is that national and local planning is not joined up. To some extent this is addressed in the Act with new joint spatial development strategies to bring together planning authorities across boundaries where there are strategic reasons to do so.

But at the local level where our clients operate, it is the promise of a speeded up, streamlined planning service that is most appealing.

Previously mooted planning overhauls have met with reticence from the planners th

For smaller and medium-sized developers, 2023 was the year that everything took longer. It took longer to find and acquire land, longer to obtain bank funding and longer to get materials delivered but most of all, it took longer to get planning permission.

There was barely a day all year when I didn’t have a discussion with a client involving planning. The industry’s frustration with the ponderous UK system is palpable.

It’s particularly galling for the SME residential developers who are typically our clients because they have fewer resources to deal with the bureaucracy and face more intense financial pressures than the big hitters, notably on cashflow. When you are stretched on a project having shelled out for a parcel of land, planning delays pile up your bank interest. Time is money.

And it is not just delays that eat cash. Even a small development of, say, two houses can incur upfront costs of £30-50,000 in planning and professional fees. For more complex projects, that number can easily top £100,000 when you factor in consultancy fees for a broader raft of planning hurdles such as right to light and environmental studies. Another big-ticket pre-planning bill can be option fees for the landowner.

Unfortunately for developers, banks dislike lending against developments pending planning applications as there are no assets in the project, which means the developer must find the cash.

These pressures have had a cataclysmic effect on smaller to medium residential developers.

According to the Federation of Master Builders, 40 years ago SME house builders delivered 40% of our homes. Today, this figure is just 12%.

Planning is not the only culprit. The FMB says the sector has been hit hard by successive recessions. They report that SME and custom builders say they struggle to access finance and land, but right up there on their list of complaints is the difficulty of navigating Britain’s complex planning system.

Our experience at Davon talking to SME residential developers throughout last year bore that out, so we were pleased to give our support to the FMB’s campaign for:

• A simplified planning system

• Making more small sites available for SME developers

• Investing in local authority planning departments to speed up the planning process

For years, successive governments have promised action to tackle the housing shortage and streamline the planning system. Yet the industry sees little or no progress and has become at least sceptical if not cynical.

The latest government initiative is the Levelling Up and Regeneration Act which became law in October 2023. It is supposed to speed up the planning system, hold developers to account, cut bureaucracy, and encourage more councils to put in place plans to enable the building of new homes.

The Act promises that new developments will be more attractive with better infrastructure such as GP surgeries, schools and transport links. Development will be shaped by local people’s democratic wishes, enhance the environment and create neighbourhoods where people want to live and work.

That all sounds great, but will it happen?

One feature of the Act that caught my eye is to give councils the power to work directly with landlords to bring empty buildings back into use by local businesses and community groups, “breathing life back into empty high streets”.

Many people in the property and construction world will tell you that converting offices and retail premises into residential is fraught with difficulty, but it can be done successfully.

Take our client, Barker Homes for example. We have provided mezzanine finance for a series of their conversion projects, the latest being a £10.5 million redevelopment to transform a town centre commercial building in Hemel Hempstead into 40 luxury apartments.

If planning policy changes can smooth the path for more of these and other kinds of conversion of redundant buildings, that would be welcome.

It will be necessary if the Act is to deliver on its objectives, which include directing growth to support the regeneration of brownfield sites and renewing and levelling up towns and cities with more homes in Britain’s largest urban centres including in the North and Midlands.

The government says that this will not only make the most of brownfield land but also maximise the use of existing infrastructure, taking advantage of structural change in urban land use and reducing the need for unnecessary travel.

One criticism we often hear is that national and local planning is not joined up. To some extent this is addressed in the Act with new joint spatial development strategies to bring together planning authorities across boundaries where there are strategic reasons to do so.

But at the local level where our clients operate, it is the promise of a speeded up, streamlined planning service that is most appealing.

Previously mooted planning overhauls have met with reticence from the planners th

UK

UK Ireland

Ireland Scotland

Scotland London

London