The proposals, published in the mortgage market review discussion paper, reflect the FSA's changed approach to a more intrusive and interventionist style of regulation.

The review's key features are:

- Imposing affordability tests for all mortgages and making lenders ultimately responsible for assessing a consumer’s ability to pay

- Banning ‘self-cert’ mortgages through required verification of borrowers’ income

- Banning the sale of products which contain certain ‘toxic combinations’ of characteristics that put borrowers at risk

- Banning arrears charges when a borrower is already repaying and ensuring firms do not profit from people in arrears

- Requiring all mortgage advisers to be personally accountable to the FSA

- Calling for the FSA’s scope to cover buy-to-let and all lending secured on a home

"The paper sets out the main findings of the FSA's comprehensive analysis of the mortgage market. It clearly shows a rapid explosion in mortgage products; the emergence of high risk lending strategies which typically focused on higher risk borrowers; relaxed credit standards; and a mutual assumption by too many borrowers and lenders that the good times could not end.

"The FSA needs to ensure that firms only lend to people who can afford to pay the money back. The reforms that we have announced today will ensure that the mortgage market works better for consumers and that it is sustainable for firms."

The proposals are designed to tackle the problems identified while maintaining a vibrant and sustainable market. But the FSA has not ruled out further change if the initial proposals do not have sufficient effect, including caps on loan-to-value, loan-to-income or debt-to-income.

(CD/KMcA)

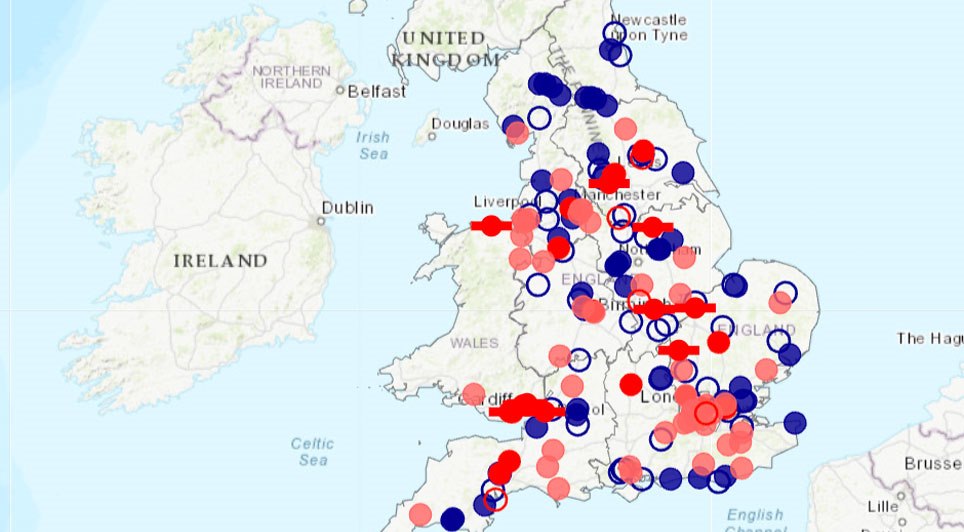

UK

UK Ireland

Ireland Scotland

Scotland London

London