Construction News

30/11/2009

Banks Called On To Lend A Further £20bn For New Homes

.gif)

Housing associations will need to borrow more than £20 billion from banks over the next five years to continue to build new homes for those most in need, according to the Tenant Services Authority (TSA).

In its latest report on the sector, the social housing regulator also indicated a continued improvement in the housing and finance market conditions, with the quarterly survey results showing that housing associations have again reduced the backlog of unsold low-cost home ownership (LCHO) properties and are still securing new investment to deliver affordable housing.

As pressure on government capital investment budgets tighten, the need for private finance to be raised at competitive rates remains central to delivering decent homes and new build targets. The TSA Board has approved a new private finance strategy to encourage existing and new banks to lend to housing associations.

The report forecasts that between £20 billion and £25 billion of new funds are required over the next five years for associations to continue to build new homes, improve existing homes, and provide quality services to tenants. The strategy sets out how the TSA will continue to maintain the confidence of the retail lending markets and encourage the expansion of institutional investment in affordable housing. Based on recent market discussions, the TSA believes that the retail market has an appetite to lend £20 billion and that a further £5-10 billion could be raised through the bond markets.

Clare Miller, Executive Director Risk and Assurance, said: "We take our role seriously in encouraging a market place that allows housing associations to build new homes for those who are on social housing waiting lists. We’ve played a crucial role over the past 12 months in being able to give confidence to lenders and investors by ensuring the financial stability of the sector – and will continue to do so.

"Many housing associations believe that the housing and financial markets have improved over the past few months – but they’re expressing cautious optimism. While we’re seeing a continued willingness to lend to the sector, we are not complacent, and we are taking action to ensure that we continue to have an active and competitive private finance market."

(CD/KMcA)

In its latest report on the sector, the social housing regulator also indicated a continued improvement in the housing and finance market conditions, with the quarterly survey results showing that housing associations have again reduced the backlog of unsold low-cost home ownership (LCHO) properties and are still securing new investment to deliver affordable housing.

As pressure on government capital investment budgets tighten, the need for private finance to be raised at competitive rates remains central to delivering decent homes and new build targets. The TSA Board has approved a new private finance strategy to encourage existing and new banks to lend to housing associations.

The report forecasts that between £20 billion and £25 billion of new funds are required over the next five years for associations to continue to build new homes, improve existing homes, and provide quality services to tenants. The strategy sets out how the TSA will continue to maintain the confidence of the retail lending markets and encourage the expansion of institutional investment in affordable housing. Based on recent market discussions, the TSA believes that the retail market has an appetite to lend £20 billion and that a further £5-10 billion could be raised through the bond markets.

Clare Miller, Executive Director Risk and Assurance, said: "We take our role seriously in encouraging a market place that allows housing associations to build new homes for those who are on social housing waiting lists. We’ve played a crucial role over the past 12 months in being able to give confidence to lenders and investors by ensuring the financial stability of the sector – and will continue to do so.

"Many housing associations believe that the housing and financial markets have improved over the past few months – but they’re expressing cautious optimism. While we’re seeing a continued willingness to lend to the sector, we are not complacent, and we are taking action to ensure that we continue to have an active and competitive private finance market."

(CD/KMcA)

29/01/2025

Caddick Construction has been awarded a £43 million contract to deliver the first phase of Cole Waterhouse's flagship regeneration scheme in Digbeth, Birmingham.

The project, known as Upper Trinity Street, marks a significant step in the area’s transformation.

Spanning 182,986 square feet, the re

29/01/2025

McLaren Construction has been appointed by O&H Properties to deliver the first phase of a £60 million Foster & Partners-designed development at the corner of New Bond Street and Grafton Street in London’s West End.

The seven-storey, 5,400 square metre prime retail and office scheme will feature ret

29/01/2025

GMI Construction Group has been awarded a contract to develop three high-specification warehouse units totalling over 175,000 square feet at Precedent Drive, Milton Keynes.

The £20 million project, commissioned by DV5 Last Mile Developments (UK) Ltd, a joint venture between Coltham and Delancey Re

29/01/2025

Plans for 106 sustainable new homes in Southville, a neighbourhood in South Bristol, have been approved as the city seeks to increase housing delivery to address growing demand.

Top 10 award-winning housebuilder The Hill Group will create a £60 million development on Raleigh Road, on land that was

29/01/2025

Bouygues UK has reached a major milestone in the fourth phase of the Hallsville Quarter regeneration project in Canning Town, London.

The project, part of the £3.7 billion Canning Town and Custom House Regeneration Programme, recently held a topping out ceremony, marking the completion of the 11-s

29/01/2025

Willmott Dixon Interiors is carrying out a significant upgrade to the roof of the National Maritime Museum in Greenwich, one of London's most iconic cultural landmarks.

As part of the £12 million project, the company is installing over 23,000 square feet of sun-protected glazing above the museum’s

29/01/2025

Equans has been appointed by Babergh and Mid Suffolk District Councils to carry out crucial decarbonisation work across the councils' housing stock, using funding secured through the Social Housing Decarbonisation Fund (SHDF).

The councils used the South East Consortium's Zero Carbon Framework to s

29/01/2025

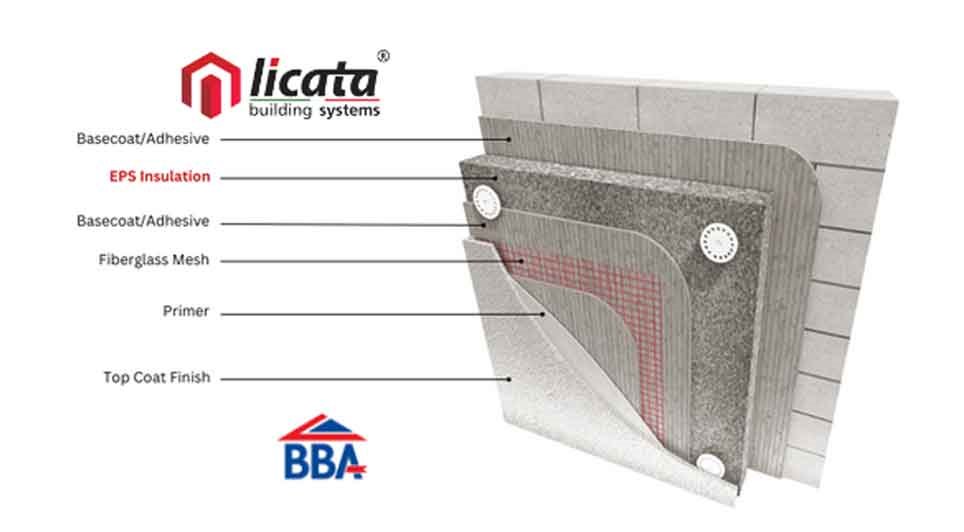

In the world of construction, the quest for energy efficiency and sustainability is ever-evolving. Among the array of solutions available, EPS (Expanded Polystyrene) insulation stands out as a versatile and effective option for enhancing the thermal performance of buildings, particularly when used f

29/01/2025

BCP Council has completed significant coastal protection works at Hamworthy Park, ensuring its resilience against erosion for the next 20 years.

A 200-metre stretch of sea wall along the eastern promenade has been reinforced using low-carbon concrete, while new steps have been constructed to improv

29/01/2025

Geo-environmental consultancy and remediation contractor, The LK Group, has strengthened its team with a trio of recruits.

The multidisciplinary company's latest raft of hires comprises a new director, associate director and remediation manager.

The geo-environmental specialist, headquartered i

UK

UK Ireland

Ireland Scotland

Scotland London

London