Mortgage lenders took 10,200 properties into possession in the fourth quarter of 2009 - 13% lower than in the third quarter, and 2% down on the fourth quarter of 2008, according to the Council of Mortgage Lenders.

This figure reflects the number of possessions taken by first charge lenders on both home-owner and buy-to-let mortgages.

In 2009 as a whole, this brought the total number of possessions to 46,000. This was lower the CML's most recent forecast of 48,000, and significantly fewer than the 75,000 forecast at the start of the year, but still 15% higher than the 40,000 in 2008.

In terms of payment difficulties, 188,300 mortgages ended the year with arrears equivalent to at least 2.5% of the outstanding mortgage balance (for example, £2,500 or more arrears on a £100,000 mortgage balance). This was lower than the 195,000 the CML had anticipated, and 3% lower than at the end of the third quarter - but still 3% higher than at the end of 2008.

Within the total number of arrears cases, there is a different picture in terms of what seems to be happening among households with lower levels of arrears (where the numbers are improving), and higher levels of arrears (where the numbers are little changed). The council said this suggests that at present some borrowers facing only modest difficulties are being helped by low interest rates to get back out of trouble, whereas those with more severe problems may be stabilising their arrears but not recovering from them, and lender forbearance is likely to be a significant factor keeping them in their homes.

Commenting on the current level of mortgage arrears, CML director general Michael Coogan said: "The fact that mortgage arrears and possessions did not rise as much as we feared in 2009 is testament to the effect of low interest rates, and a great deal of concerted effort by lenders, government and the advice sector to help borrowers to address financial difficulties when they occur.

"We are not out of the woods yet - 2010 will still be a challenging year for many borrowers, and some households will inevitably find their finances being squeezed if and when interest rates do eventually rise. But borrowers should feel reassured that lenders want to help them keep their homes wherever possible.

"The vast majority of people who get into arrears manage to keep their homes, and will do so even if interest rates rise. Seeking advice as soon as financial problems occur will help to minimise the risk of the situation getting out of control."

Speaking on the day the Homeowner and Debtor Protection (Scotland) Bill (1), goes through its final stages, Graeme Brown, Director, Shelter Scotland, housing and homelessness charity, said: "Mortgage repossessions may not have reached the peaks predicted a year ago – but this is testament to the work carried out by the Scottish and UK Governments and the forbearance of responsible lenders. But as the CML says today, we are not out of the woods, particularly with predictions of 53,000 repossessions this year. This is no time for complacency. Mortgage repossessions are still higher than five years ago. Interest rates are low and lenders forbearance may not continue forever. Reform of mortgage protection is a must for these reasons."

He added: "The Scottish Government’s action to bring forward these additional protections for homeowners is timely, particularly amid the current financial climate, and Scotland’s flagship commitment to give everyone the right to a home by 2012."

(GK/BMcC)

Construction News

11/02/2010

Decline In Mortgage Arrears And Repossessions

.gif)

08/04/2025

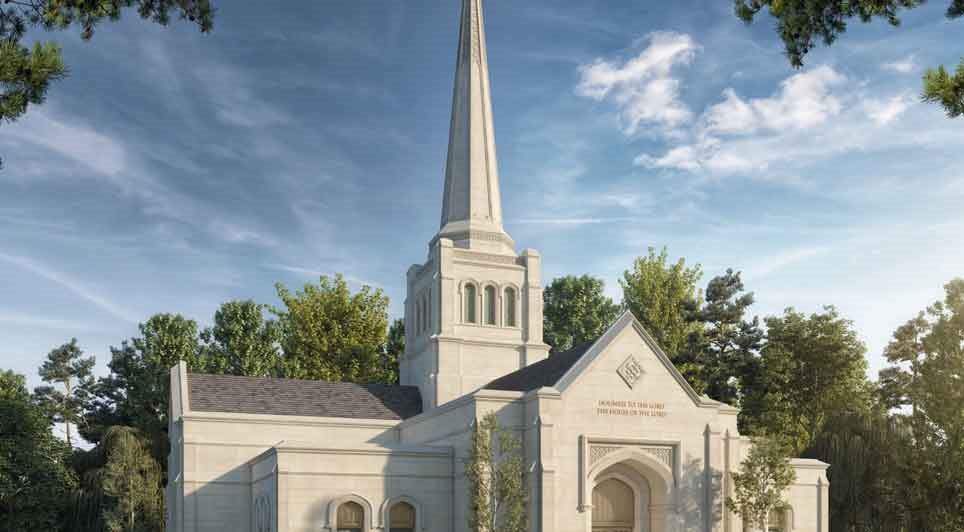

McLaren Construction Midlands and North has officially announced its role in delivering the highly anticipated Birmingham England Temple for The Church of Jesus Christ of Latter-day Saints.

The project commenced with a ceremonial groundbreaking, attended by over 300 guests and live-streamed globall

08/04/2025

The University of Warwick's vision to create world-leading STEM facilities has taken a major step forward with the appointment of Kier as the preferred lead contractor to deliver Phase 1 of its STEM Connect Programme.

The announcement marks a significant milestone in the University's wider Connect

08/04/2025

Building work has officially commenced on a new Football Foundation PlayZone in Southwick.

The new multi-sport pitch is designed to offer football and basketball opportunities to people of all ages and abilities.

The development of the PlayZone has been made possible through a £198,076 grant from

08/04/2025

Avant Homes has announced the acquisition of a 20.1-acre site in Yaddlethorpe and received planning permission to deliver a new £45 million residential development including 200 homes.

Named Moorwell Meadows, the new development will be located off Scotter Road South and will feature a variety of t

08/04/2025

Applebridge Geoenvironmental, part of the Applebridge Family Construction Group, has been appointed for the Severn Trent Water & Hafren Dyfrdwy Ground Investigation Framework.

The framework, valued at £36 million over a three-year period, brings together 12 contractors to undertake vital ground inv

08/04/2025

When business is booming and demand is on the rise, your warehouse's production capacity can start to feel the strain.

While some companies might consider relocating or expanding their premises, there's a smarter solution that doesn't involve moving out—move up instead.

08/04/2025

Fibre cement is a versatile and robust building material that has gained popularity among the construction industry in recent years due to its strength, durability, and low maintenance qualities.

Fibre cement is made from a mixture of cement, cellulose fibres, sand, and other additives that are co

08/04/2025

Peabody's regeneration of South Thamesmead has reached a major milestone, with a topping out ceremony held to celebrate the latest phase of the transformation.

The event marked the progress of Phase Two of Peabody's seven-phase masterplan, a joint venture with housebuilder Lovell, which will delive

07/04/2025

GRAHAM has secured a partnership contract with Solihull Council for the delivery of hard facilities management (FM) services under the established Property Services and Maintenance Partnership.

The new agreement, awarded after a competitive procurement process, extends a relationship with Solihull

07/04/2025

Fleete has started construction on what is believed to be the largest dedicated commercial vehicle electric charging hub in the UK.

The shared facility, located in the Port of Tilbury, is on track for completion in December 2025.

The project marks the first works funded by the UK Government under

UK

UK Ireland

Ireland Scotland

Scotland London

London