A £190m fund which provides hard-up families with free debt advice, low cost loans and access to bank accounts is likely to be scrapped this year as the government continues its radical public spending cuts.

Ministers have failed to offer any reassurances that various financial initiatives to help low-income households, such as The Financial Inclusion Fund, The Growth Fund and Saving Gateway, will be continued beyond the end of March.

These schemes have provided thousands of families with easy access to affordable credit and financial help, encouraging people to develop sensible money-handling skills and saving habits.

The National Housing Federation, which represents England's housing associations, fears that the axing of these funds will have a widespread impact and could ultimately leave many people across the country at risk of falling into the hands of predatory loan sharks and deepening levels of debt.

The initiatives were launched to tackle the 'financially excluded', meaning people who had no access to Money Advice, no bank account, no assets, no insurance, no affordable credit or no savings.

The Financial Inclusion Fund specifically targeted zones which have been neglected by private banking firms, taking free face-to-face money advice to those who needed it most.

The Growth Fund aimed to increase the availability of personal loans by working with not-for-profit lenders to provide safe and affordable credit. This fund has provided 271,085 loans, and has also seen 145,841 Growth Fund borrowers open bank or savings accounts.

Other axed initiatives include the Saving Gateway scheme, designed to help lower-income families develop a saving habit.

The cuts come at a time when financial support for low income families is more important than ever as jobs dry up and benefit payments are reduced.

The Federation is calling for banks and the government to better provide for the financially vulnerable.

Federation Chief Executive David Orr said: "These schemes have provided vulnerable families with a financial lifeline over recent years by offering affordable loans, debt advice and banks accounts.

"If these services disappear, there's a very real danger that loan sharks and doorstep lenders will fill the void and suck people into chronic levels of debt and hardship.

"The banks and government have a moral responsibility to help families in deprived communities access the financial services many of us take for granted every day."

(CD/GK)

Construction News

07/02/2011

Multi-Million Fund For Vulnerable Likely To Be Scrapped

08/04/2025

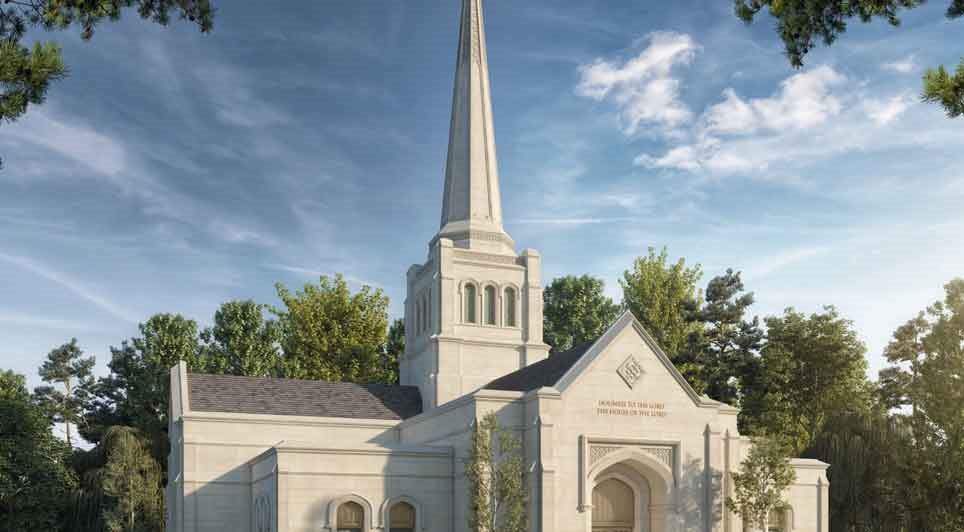

McLaren Construction Midlands and North has officially announced its role in delivering the highly anticipated Birmingham England Temple for The Church of Jesus Christ of Latter-day Saints.

The project commenced with a ceremonial groundbreaking, attended by over 300 guests and live-streamed globall

08/04/2025

The University of Warwick's vision to create world-leading STEM facilities has taken a major step forward with the appointment of Kier as the preferred lead contractor to deliver Phase 1 of its STEM Connect Programme.

The announcement marks a significant milestone in the University's wider Connect

08/04/2025

Building work has officially commenced on a new Football Foundation PlayZone in Southwick.

The new multi-sport pitch is designed to offer football and basketball opportunities to people of all ages and abilities.

The development of the PlayZone has been made possible through a £198,076 grant from

08/04/2025

Avant Homes has announced the acquisition of a 20.1-acre site in Yaddlethorpe and received planning permission to deliver a new £45 million residential development including 200 homes.

Named Moorwell Meadows, the new development will be located off Scotter Road South and will feature a variety of t

08/04/2025

Applebridge Geoenvironmental, part of the Applebridge Family Construction Group, has been appointed for the Severn Trent Water & Hafren Dyfrdwy Ground Investigation Framework.

The framework, valued at £36 million over a three-year period, brings together 12 contractors to undertake vital ground inv

08/04/2025

When business is booming and demand is on the rise, your warehouse's production capacity can start to feel the strain.

While some companies might consider relocating or expanding their premises, there's a smarter solution that doesn't involve moving out—move up instead.

08/04/2025

Fibre cement is a versatile and robust building material that has gained popularity among the construction industry in recent years due to its strength, durability, and low maintenance qualities.

Fibre cement is made from a mixture of cement, cellulose fibres, sand, and other additives that are co

08/04/2025

Peabody's regeneration of South Thamesmead has reached a major milestone, with a topping out ceremony held to celebrate the latest phase of the transformation.

The event marked the progress of Phase Two of Peabody's seven-phase masterplan, a joint venture with housebuilder Lovell, which will delive

07/04/2025

GRAHAM has secured a partnership contract with Solihull Council for the delivery of hard facilities management (FM) services under the established Property Services and Maintenance Partnership.

The new agreement, awarded after a competitive procurement process, extends a relationship with Solihull

07/04/2025

Fleete has started construction on what is believed to be the largest dedicated commercial vehicle electric charging hub in the UK.

The shared facility, located in the Port of Tilbury, is on track for completion in December 2025.

The project marks the first works funded by the UK Government under

UK

UK Ireland

Ireland Scotland

Scotland London

London