Construction News

08/12/2011

Less Can Be More

Responding to David Cameron's Prime Ministerial rallying call to the nation, Professor Benfield urges the Chancellor of Exchequer to grant home extenders and improvers a two year VAT 'holiday'.

Arguing that this could quickly create thousands of jobs without damaging the nation's finances, he calculates that this could even bring more money into Britain's coffers to help reduce our indebtedness.

Many people are calling for the Chancellor of the Exchequer, George Osborne to cut VAT, but take care...

A blanket VAT giveaway will NOT work

Recent calls to lower VAT across the board will not create jobs. Alistair Darling's one-year

21⁄2% VAT reduction evidenced this. The supposed £12.5 billion cost of that little exercise is very similar to the £12 billion now being spoken of for a similar misdirected effort to create UK economic growth.

A blanket reduction in VAT may increase some retail sales. But, in doing so, it will most

probably suck in imports and lead to a general worsening of the UK’s balance of trade.

Moreover, such reduction would not address any real and urgent imperative in society – other than some spurious claim that it might lead to an increase in GDP.

Target Any VAT Reduction Wisely

Conversely, totally removing the 20% VAT on building extensions & improvements for a 1 or 2 year period would almost immediately put tens of thousands of builders and tradesmen back to work. As explained below, it would capitalise on the desire of property owners to upgrade their buildings, giving them the reason to invest savings and other money in property value, and create a real 'buzz' of productive activity that could change the outlook of many Britons.

Moreover, it could actually lead to a net growth in the Chancellors Tax-take, helping reduce the national debt and strengthen the national economy, the sums are pretty simple.

While I don’t have access to the sophisticated modelling used by the Treasury, Bonk of

England, CBI, et al, a reasonable approximation may be achieved using fairly basic

assessments.

Historically, until the recession, some 240,000 home extensions were carried out in the UK each year. Along with other construction work this has been roughly halved to perhaps 120,000. This means that over the last 2 years some 240,000 such projects have been put on hold. Add a further 120,000 for the year ahead and we have 360,000 that might be considered ready and waiting to go ahead.

Less Can Be More

How investing’ in a small VAT giveaway could create 800,000 jobs and yield near 85%

financial return for Britain Professor Michael Benfield.

However, a one-year VAT holiday on home extensions and improvements (it may need to be longer to allow for delays in the planning system and getting jobs mobilised) would kick start further massive pent up demand for these. Slow housing markets, and other disincentives to moving house means this is actually growing all the time. Encouraging thousands of homeowners and residential landlords, not to mention owners of other property, to bring forward improvement projects, would also secure more jobs in, for example, soft furnishings and white goods.

Think Of It This Way

Overall – and for the sake of argument – assume that the historical 240,000 p.a. or so such projects was doubled to 480,000 for a year. Assuming a high average spend of £50,000 each, this would be £24 billion gross work value per year.

One year's loss of VAT on this would only cost £4.2 billion.

Now assume a low 40% labour to materials value on that £24 billion and such new work

would create £9.6 billion of wage income. At an average £20,000 per job that adds up to 480,000 jobs.

At average income tax rates of 25% on the £13,000 or so of taxable income per job, this

would yield £3,250 per job, or some £1.56 billion in total.

Perhaps one third of the 60%, or £14.4 billion to be spent on materials and components,

would also find its way into additional jobs, Rather conveniently that works out at £4.8 billion, or half that for direct construction jobs, Thus we could see around an additional 240,000 jobs to yield another £0.78 billion of income tax.

Happily the sums don’t end here

If we anticipate that overall the businesses through which this £24 billion of work passes

make an average of 10% profit before tax, i.e. £2.4 billion and pay only the small company corporation tax rate of 19%, and the Government receives a further £0.446 billion into its coffers.

But we are still not done

So far we have seen that perhaps 720,000 jobs can be created, paying a total of £14.4 billion in wages, or £14.336 billion after income tax has been paid. Although there seems to be no common agreement on how income is used, allowing the £8,424 per family disposable annual income reported by The Guardian (27 Sept 2011), this could mean £6.07 billion to spend in VAT able goods, potentially yielding another £1.21 billion for HM Revenue & Customs.

Assuming now that only one quarter of this extra spend would go on jobs, at the average

£20K each assumed in this article, that adds up to around another 76,000 jobs.

Again they pay income tax that could amount to another £0.247 billion, and spend their

disposable income of £0.64 billion, to yield £0.049 of VAT.

Taking 800,000 people off even basic unemployment benefit of say, £3,600 per year would add back a further £2.88 billion leading to a total £3.54 billion financial return for a £4.2 billion outlay spread over 12 months.

Come on George, ... even you and David should be able to see that an 84.29% return on our money should be too good for even the most die-hard fiscal fundamentalist to ignore.

Especially if you are a Tory!

For further info Visit: http://www.BenfieldATTgroup.co.uk/ or Email: info@BenfieldATTgroup.co.uk

Arguing that this could quickly create thousands of jobs without damaging the nation's finances, he calculates that this could even bring more money into Britain's coffers to help reduce our indebtedness.

Many people are calling for the Chancellor of the Exchequer, George Osborne to cut VAT, but take care...

A blanket VAT giveaway will NOT work

Recent calls to lower VAT across the board will not create jobs. Alistair Darling's one-year

21⁄2% VAT reduction evidenced this. The supposed £12.5 billion cost of that little exercise is very similar to the £12 billion now being spoken of for a similar misdirected effort to create UK economic growth.

A blanket reduction in VAT may increase some retail sales. But, in doing so, it will most

probably suck in imports and lead to a general worsening of the UK’s balance of trade.

Moreover, such reduction would not address any real and urgent imperative in society – other than some spurious claim that it might lead to an increase in GDP.

Target Any VAT Reduction Wisely

Conversely, totally removing the 20% VAT on building extensions & improvements for a 1 or 2 year period would almost immediately put tens of thousands of builders and tradesmen back to work. As explained below, it would capitalise on the desire of property owners to upgrade their buildings, giving them the reason to invest savings and other money in property value, and create a real 'buzz' of productive activity that could change the outlook of many Britons.

Moreover, it could actually lead to a net growth in the Chancellors Tax-take, helping reduce the national debt and strengthen the national economy, the sums are pretty simple.

While I don’t have access to the sophisticated modelling used by the Treasury, Bonk of

England, CBI, et al, a reasonable approximation may be achieved using fairly basic

assessments.

Historically, until the recession, some 240,000 home extensions were carried out in the UK each year. Along with other construction work this has been roughly halved to perhaps 120,000. This means that over the last 2 years some 240,000 such projects have been put on hold. Add a further 120,000 for the year ahead and we have 360,000 that might be considered ready and waiting to go ahead.

Less Can Be More

How investing’ in a small VAT giveaway could create 800,000 jobs and yield near 85%

financial return for Britain Professor Michael Benfield.

However, a one-year VAT holiday on home extensions and improvements (it may need to be longer to allow for delays in the planning system and getting jobs mobilised) would kick start further massive pent up demand for these. Slow housing markets, and other disincentives to moving house means this is actually growing all the time. Encouraging thousands of homeowners and residential landlords, not to mention owners of other property, to bring forward improvement projects, would also secure more jobs in, for example, soft furnishings and white goods.

Think Of It This Way

Overall – and for the sake of argument – assume that the historical 240,000 p.a. or so such projects was doubled to 480,000 for a year. Assuming a high average spend of £50,000 each, this would be £24 billion gross work value per year.

One year's loss of VAT on this would only cost £4.2 billion.

Now assume a low 40% labour to materials value on that £24 billion and such new work

would create £9.6 billion of wage income. At an average £20,000 per job that adds up to 480,000 jobs.

At average income tax rates of 25% on the £13,000 or so of taxable income per job, this

would yield £3,250 per job, or some £1.56 billion in total.

Perhaps one third of the 60%, or £14.4 billion to be spent on materials and components,

would also find its way into additional jobs, Rather conveniently that works out at £4.8 billion, or half that for direct construction jobs, Thus we could see around an additional 240,000 jobs to yield another £0.78 billion of income tax.

Happily the sums don’t end here

If we anticipate that overall the businesses through which this £24 billion of work passes

make an average of 10% profit before tax, i.e. £2.4 billion and pay only the small company corporation tax rate of 19%, and the Government receives a further £0.446 billion into its coffers.

But we are still not done

So far we have seen that perhaps 720,000 jobs can be created, paying a total of £14.4 billion in wages, or £14.336 billion after income tax has been paid. Although there seems to be no common agreement on how income is used, allowing the £8,424 per family disposable annual income reported by The Guardian (27 Sept 2011), this could mean £6.07 billion to spend in VAT able goods, potentially yielding another £1.21 billion for HM Revenue & Customs.

Assuming now that only one quarter of this extra spend would go on jobs, at the average

£20K each assumed in this article, that adds up to around another 76,000 jobs.

Again they pay income tax that could amount to another £0.247 billion, and spend their

disposable income of £0.64 billion, to yield £0.049 of VAT.

Taking 800,000 people off even basic unemployment benefit of say, £3,600 per year would add back a further £2.88 billion leading to a total £3.54 billion financial return for a £4.2 billion outlay spread over 12 months.

Come on George, ... even you and David should be able to see that an 84.29% return on our money should be too good for even the most die-hard fiscal fundamentalist to ignore.

Especially if you are a Tory!

For further info Visit: http://www.BenfieldATTgroup.co.uk/ or Email: info@BenfieldATTgroup.co.uk

29/01/2025

Caddick Construction has been awarded a £43 million contract to deliver the first phase of Cole Waterhouse's flagship regeneration scheme in Digbeth, Birmingham.

The project, known as Upper Trinity Street, marks a significant step in the area’s transformation.

Spanning 182,986 square feet, the re

29/01/2025

McLaren Construction has been appointed by O&H Properties to deliver the first phase of a £60 million Foster & Partners-designed development at the corner of New Bond Street and Grafton Street in London’s West End.

The seven-storey, 5,400 square metre prime retail and office scheme will feature ret

29/01/2025

GMI Construction Group has been awarded a contract to develop three high-specification warehouse units totalling over 175,000 square feet at Precedent Drive, Milton Keynes.

The £20 million project, commissioned by DV5 Last Mile Developments (UK) Ltd, a joint venture between Coltham and Delancey Re

29/01/2025

Plans for 106 sustainable new homes in Southville, a neighbourhood in South Bristol, have been approved as the city seeks to increase housing delivery to address growing demand.

Top 10 award-winning housebuilder The Hill Group will create a £60 million development on Raleigh Road, on land that was

29/01/2025

Bouygues UK has reached a major milestone in the fourth phase of the Hallsville Quarter regeneration project in Canning Town, London.

The project, part of the £3.7 billion Canning Town and Custom House Regeneration Programme, recently held a topping out ceremony, marking the completion of the 11-s

29/01/2025

Willmott Dixon Interiors is carrying out a significant upgrade to the roof of the National Maritime Museum in Greenwich, one of London's most iconic cultural landmarks.

As part of the £12 million project, the company is installing over 23,000 square feet of sun-protected glazing above the museum’s

29/01/2025

Equans has been appointed by Babergh and Mid Suffolk District Councils to carry out crucial decarbonisation work across the councils' housing stock, using funding secured through the Social Housing Decarbonisation Fund (SHDF).

The councils used the South East Consortium's Zero Carbon Framework to s

29/01/2025

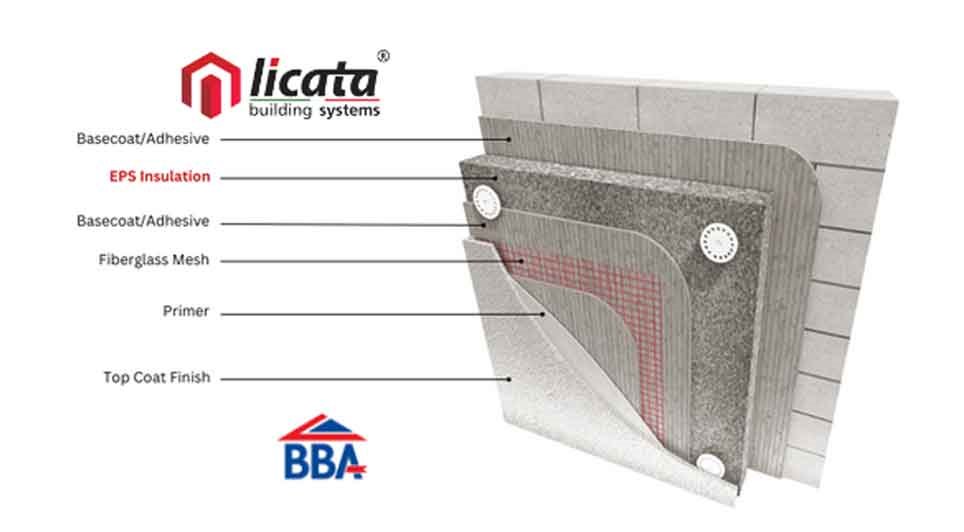

In the world of construction, the quest for energy efficiency and sustainability is ever-evolving. Among the array of solutions available, EPS (Expanded Polystyrene) insulation stands out as a versatile and effective option for enhancing the thermal performance of buildings, particularly when used f

29/01/2025

BCP Council has completed significant coastal protection works at Hamworthy Park, ensuring its resilience against erosion for the next 20 years.

A 200-metre stretch of sea wall along the eastern promenade has been reinforced using low-carbon concrete, while new steps have been constructed to improv

29/01/2025

Geo-environmental consultancy and remediation contractor, The LK Group, has strengthened its team with a trio of recruits.

The multidisciplinary company's latest raft of hires comprises a new director, associate director and remediation manager.

The geo-environmental specialist, headquartered i

UK

UK Ireland

Ireland Scotland

Scotland London

London