A scheme to help thousands of people buy their own home will be launched next week - three months earlier than planned.

The scheme was due to start in January 2014 but the government has announced that people will be able to start applying for the new mortgage guarantee from next week.

Several high street banks will be offering the new Help to Buy mortgages to customers, ranging from 80 to 95 per cent of the property's value.

The mortgages – backed by the government - will help thousands of people buy new or existing homes up to a maximum value of £600,000.

It is aimed at people who cannot get on the property ladder – or move to a new home – because they cannot afford the large deposit required, often up to 20 per cent.

Under the new mortgage guarantee scheme, the buyer would only need a 5 per cent deposit.

The government and the bank then jointly guarantees up to the next 15 per cent of the property’s value, in return for a fee paid for by the lender.

To be able to offer the guarantees ahead of schedule, the government will be allowing lenders to start writing loans that will become part of the scheme once it opens in January.

Because lenders know that they will be able to purchase a guarantee on these loans when the scheme opens in January, it means that they are able to offer high loan to value mortgages, much sooner.

Only repayment mortgages will be offered under the scheme.

There will be tough checks to make sure buyers can afford their mortgage payments and the borrowers income will be verified.

The scheme will not include interest-only or self-certified mortgages.

The new mortgages will not be available to people with a history of difficulties making debt repayments.

Official statistics show that mortgage lending is around half the level it was before the economic crisis, even though mortgage rates are at their lowest for five years.

Announced by the Chancellor at Budget 2013, the Help to Buy scheme has two parts, equity loan and mortgage guarantee.

Under the equity loan scheme, the government provides a loan of up to 20% of the value of a new build home, interest free for the first five years.

(CD/MH)

Construction News

30/09/2013

Mortgage Scheme Launches Three Months Early

09/04/2025

The Security Event, one of the UK's leading exhibitions for the security industry, has returned to the NEC Birmingham until 10 April 2025.

Bringing together the full spectrum of the security sector, from manufacturers and distributors to installers, integrators, consultants and end users, the even

09/04/2025

Kier and Pembrokeshire County Council have marked the official start of construction on the Haverfordwest Public Transport Interchange (HPTI) with a traditional ground-breaking ceremony, celebrating a major milestone for the town's regeneration.

The event, held on site, was attended by key council

09/04/2025

Morgan Sindall Infrastructure has announced the expansion of its Digital and Data Academy in partnership with Multiverse, following the success of its latest cohort of graduating apprentices.

The move reinforces the company's commitment to upskilling its workforce and harnessing the power of data t

09/04/2025

The Chesterton Partnership, a joint venture led by developer Brookgate, has announced that blocwork will deliver the residential phase of development at Cambridge North, bringing forward over 400 new homes as part of the wider regeneration scheme.

Located around Cambridge North Station, the emergin

09/04/2025

A major investment to improve living standards across the army estate has reached a key milestone with the completion of new Single Living Accommodation (SLA) at St George's Barracks in Bicester.

The newly completed block provides 72 ensuite single bedrooms for Junior Rank soldiers, along with mode

09/04/2025

In a landmark development for Bedford Borough, Elected Mayor Tom Wootton has officially announced that Universal Destinations & Experiences will establish a world-class theme park and resort just south of Bedford, on the site of a former brickworks. The project marks a major milestone, positioning B

09/04/2025

The Health & Safety Event, currently underway at the NEC Birmingham, is attracting industry professionals from across the UK as it showcases the latest products, solutions, and innovations for workplace safety.

Running until April 10, the event has firmly established itself as the UK's premier mee

09/04/2025

Sheffield is once again proving its industrial innovation credentials, as a new agreement between E.ON UK and Marcegaglia Stainless Steel will see waste heat from steel production repurposed to provide low-carbon heating to homes and businesses across the city.

A Memorandum of Understanding (MoU) h

08/04/2025

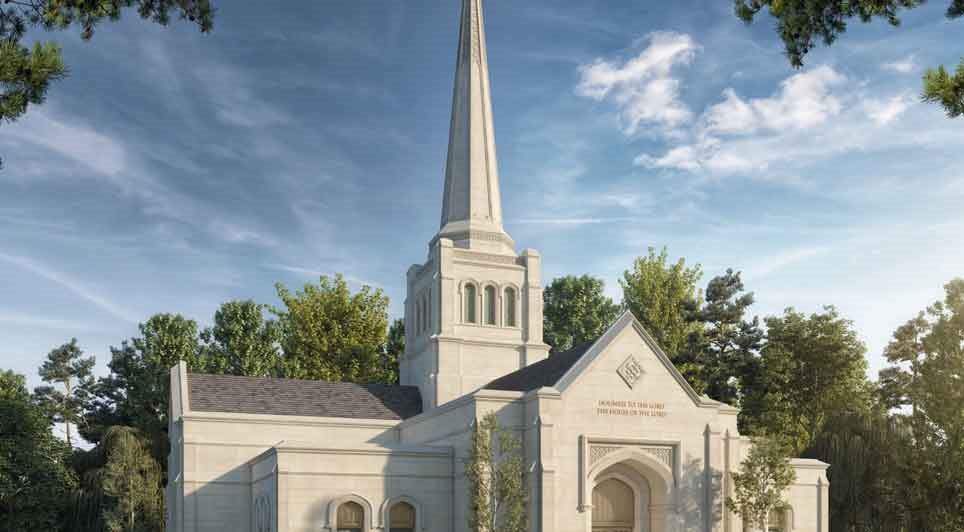

McLaren Construction Midlands and North has officially announced its role in delivering the highly anticipated Birmingham England Temple for The Church of Jesus Christ of Latter-day Saints.

The project commenced with a ceremonial groundbreaking, attended by over 300 guests and live-streamed globall

08/04/2025

The University of Warwick's vision to create world-leading STEM facilities has taken a major step forward with the appointment of Kier as the preferred lead contractor to deliver Phase 1 of its STEM Connect Programme.

The announcement marks a significant milestone in the University's wider Connect

UK

UK Ireland

Ireland Scotland

Scotland London

London