Construction News

03/10/2017

UK Industry Activity Falls For First Time In 13 Months

New figures have revealed a fall in UK construction business activity for the first time in 13 months.

The seasonally adjusted IHS Markit/CIPS UK Construction Purchasing Managers' Index® (PMI) recorded 48.1 in September, down from 51.1 in August.

Respondents stated lower volumes of work in both commercial and civil engineering activity during September contributed towards the decline, while a civil engineering work witnessed its steepest reduction for almost four-and-a-half years. Some firms linked this to a lack of new infrastructure projects to replace completed contracts.

Elsewhere, work on commercial developments also decined, with the latest fall only the second-sharpest since February 2013 (however exceeded only by the post-EU referendum dip seen last July). Survey respondents widely commented on a headwind from political and economic uncertainty, alongside extended lead times for budget approvals among clients.

New business volumes also dropped for the third consecutive month, suggesting a continued shortage of work to replace completed construction projects. Despite the downturn seen around the EU referendum last year, the current period of decline is the longest recorded since early- 2013. This in turn led to falls in sub-contractor usage and a relatively weak rate of job creation among construction firms during September.

Input buying decreased for the first time in six months, largely in response to reduced workloads across the sector, while lower demand for materials helped to alleviate some strain on supply chains, as delivery times from vendors lengthened to the lowest extent since November 2016. However, companies ocntineu to face challenges from rising input costs, with higher prices for imported materials helping to drive up inflationary pressures to a seven-month high.

Despite various falls, housebuilding was the only area to register an expansion in September. However, growth momentum eased to a six-month low amid reports citing worries about less favourable market conditions ahead.

Looking to the future, business optimism has eased to its second-lowest since April 2013, with a number of firms citiing concerns about UK business investment prospects, linked to uncertainty around the path to Brexit.

Duncan Brock, Director of Customer Relationships at the Chartered Institute of Procurement & Supply, said: "A dismal picture of construction emerged this month as the sector showed signs of worsening business conditions across the board. With the biggest contraction in overall activity since July 2016, and a drop in new orders, optimism was in short supply.

"Respondents pointed to obstructive economic conditions and the Brexit blight of uncertainty, freezing clients into indecision over new projects. Even housing, the stalwart of the construction sector stuttered with a dwindling performance, but civil engineering was the biggest victim falling to its weakest level for four and a half years.

"The contagion continued all along the supply chain as material shortages placed a strain on delivery times and increased commodity prices were affected by the weak pound. Despite a marginal increase in employment figures, this wasn't enough to dispel the descending autumnal gloom where it is unclear where any major shift in momentum for the sector will come in the next few months."

(LM)

The seasonally adjusted IHS Markit/CIPS UK Construction Purchasing Managers' Index® (PMI) recorded 48.1 in September, down from 51.1 in August.

Respondents stated lower volumes of work in both commercial and civil engineering activity during September contributed towards the decline, while a civil engineering work witnessed its steepest reduction for almost four-and-a-half years. Some firms linked this to a lack of new infrastructure projects to replace completed contracts.

Elsewhere, work on commercial developments also decined, with the latest fall only the second-sharpest since February 2013 (however exceeded only by the post-EU referendum dip seen last July). Survey respondents widely commented on a headwind from political and economic uncertainty, alongside extended lead times for budget approvals among clients.

New business volumes also dropped for the third consecutive month, suggesting a continued shortage of work to replace completed construction projects. Despite the downturn seen around the EU referendum last year, the current period of decline is the longest recorded since early- 2013. This in turn led to falls in sub-contractor usage and a relatively weak rate of job creation among construction firms during September.

Input buying decreased for the first time in six months, largely in response to reduced workloads across the sector, while lower demand for materials helped to alleviate some strain on supply chains, as delivery times from vendors lengthened to the lowest extent since November 2016. However, companies ocntineu to face challenges from rising input costs, with higher prices for imported materials helping to drive up inflationary pressures to a seven-month high.

Despite various falls, housebuilding was the only area to register an expansion in September. However, growth momentum eased to a six-month low amid reports citing worries about less favourable market conditions ahead.

Looking to the future, business optimism has eased to its second-lowest since April 2013, with a number of firms citiing concerns about UK business investment prospects, linked to uncertainty around the path to Brexit.

Duncan Brock, Director of Customer Relationships at the Chartered Institute of Procurement & Supply, said: "A dismal picture of construction emerged this month as the sector showed signs of worsening business conditions across the board. With the biggest contraction in overall activity since July 2016, and a drop in new orders, optimism was in short supply.

"Respondents pointed to obstructive economic conditions and the Brexit blight of uncertainty, freezing clients into indecision over new projects. Even housing, the stalwart of the construction sector stuttered with a dwindling performance, but civil engineering was the biggest victim falling to its weakest level for four and a half years.

"The contagion continued all along the supply chain as material shortages placed a strain on delivery times and increased commodity prices were affected by the weak pound. Despite a marginal increase in employment figures, this wasn't enough to dispel the descending autumnal gloom where it is unclear where any major shift in momentum for the sector will come in the next few months."

(LM)

29/01/2025

Caddick Construction has been awarded a £43 million contract to deliver the first phase of Cole Waterhouse's flagship regeneration scheme in Digbeth, Birmingham.

The project, known as Upper Trinity Street, marks a significant step in the area’s transformation.

Spanning 182,986 square feet, the re

29/01/2025

McLaren Construction has been appointed by O&H Properties to deliver the first phase of a £60 million Foster & Partners-designed development at the corner of New Bond Street and Grafton Street in London’s West End.

The seven-storey, 5,400 square metre prime retail and office scheme will feature ret

29/01/2025

GMI Construction Group has been awarded a contract to develop three high-specification warehouse units totalling over 175,000 square feet at Precedent Drive, Milton Keynes.

The £20 million project, commissioned by DV5 Last Mile Developments (UK) Ltd, a joint venture between Coltham and Delancey Re

29/01/2025

Plans for 106 sustainable new homes in Southville, a neighbourhood in South Bristol, have been approved as the city seeks to increase housing delivery to address growing demand.

Top 10 award-winning housebuilder The Hill Group will create a £60 million development on Raleigh Road, on land that was

29/01/2025

Bouygues UK has reached a major milestone in the fourth phase of the Hallsville Quarter regeneration project in Canning Town, London.

The project, part of the £3.7 billion Canning Town and Custom House Regeneration Programme, recently held a topping out ceremony, marking the completion of the 11-s

29/01/2025

Willmott Dixon Interiors is carrying out a significant upgrade to the roof of the National Maritime Museum in Greenwich, one of London's most iconic cultural landmarks.

As part of the £12 million project, the company is installing over 23,000 square feet of sun-protected glazing above the museum’s

29/01/2025

Equans has been appointed by Babergh and Mid Suffolk District Councils to carry out crucial decarbonisation work across the councils' housing stock, using funding secured through the Social Housing Decarbonisation Fund (SHDF).

The councils used the South East Consortium's Zero Carbon Framework to s

29/01/2025

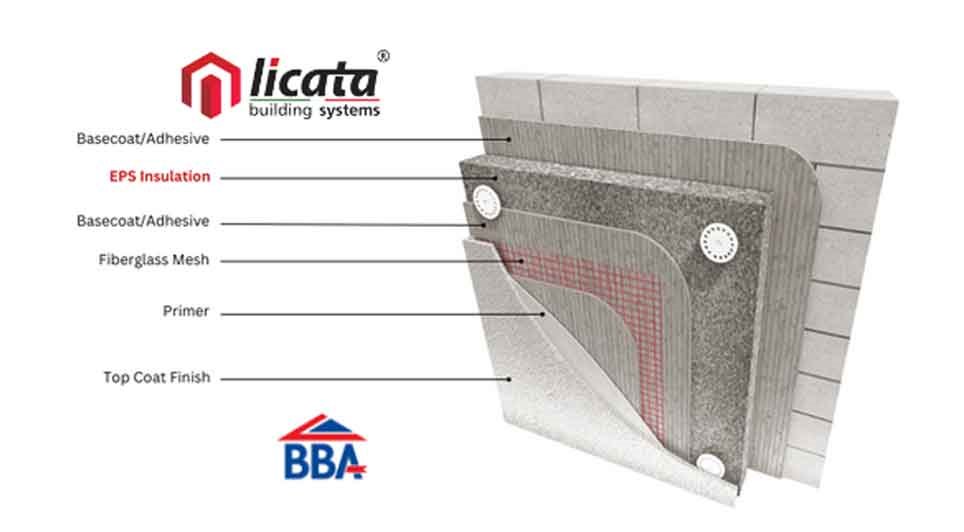

In the world of construction, the quest for energy efficiency and sustainability is ever-evolving. Among the array of solutions available, EPS (Expanded Polystyrene) insulation stands out as a versatile and effective option for enhancing the thermal performance of buildings, particularly when used f

29/01/2025

BCP Council has completed significant coastal protection works at Hamworthy Park, ensuring its resilience against erosion for the next 20 years.

A 200-metre stretch of sea wall along the eastern promenade has been reinforced using low-carbon concrete, while new steps have been constructed to improv

29/01/2025

Geo-environmental consultancy and remediation contractor, The LK Group, has strengthened its team with a trio of recruits.

The multidisciplinary company's latest raft of hires comprises a new director, associate director and remediation manager.

The geo-environmental specialist, headquartered i

UK

UK Ireland

Ireland Scotland

Scotland London

London