Construction News

03/07/2018

Residential And Commercial Work Boosts UK Output In June

The UK's construction output growth hit a seven-month high in June thanks to a boost in both residential and commercial work.

The seasonally adjusted IHS Markit/CIPS UK Construction Purchasing Managers' Index (PMI) posted 53.1 in June, up from 52.5 in May and above the 50.0 no-change value for the third month running.

With the latest reading pointing to the sharpest overall rise in output since November 2017, the increase marks three months of sustained recovery following the snow-related disruption experienced in March.

Residential works remained the best performing area, while commercial building also contributed to the stronger overall rise in construction output, expanding at its fastest pace since February. Yet, civil engineering activity rose only slightly in June, with the rate of growth easing to a three-month low.

Firms noted that a general improvement in client demand had helped to boost construction workloads in June, with figures indicating a solid rebound in new order volumes following the decline seen during the previous month. The rate of new business growth was the strongest for just over one year in June.

In addition, higher levels of new work contributed to faster increases in employment numbers and purchasing activity during June. The rate of job creation accelerated to its strongest for one year, while the latest rise in input buying was the steepest since December 2015. Survey respondents noted that greater purchasing activity reflected new projects starts and, in some cases, forward purchasing of inputs to mitigate forthcoming price rises from suppliers.

Elsewhere, average cost burdens increased at a share and accelerated pace in June, with the latest rise in input prices being its steepest for nine months. Respondents attributed this to greater transportation costs and higher prices for metals (especially steel). Meanwhile, vendor lead times lengthened again in June, driven by low stocks and capacity constraints among suppliers.

On the sector's future outlook, companies indicated a rebound in business optimism from May's seven-month low, although the degree of positive sentiment remained much weaker than the long-run survey average. Overall, firms cited infrastructure work as a key source of growth in the coming 12 months.

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said: "With the fastest rise in new orders since May 2017, it appears the brakes are off for the construction sector. Despite being hampered by economic uncertainty, firms reported an improved pipeline of work as clients committed to projects and hesitancy was swept away.

"Input prices were a challenge with the biggest inflationary rise since September 2017, so the pressure was on to build up stocks of materials rising in price and becoming more scarce. This resulted in a heavy impact on suppliers unable to keep pace as deliveries became laboured and purchasing managers were at their busiest for two and a half years.

"Housing continued on its positive trajectory for a fifth month and commercial activity also improved after a weak start to the second quarter. However, before we bring out the bunting, the sector is not out of the woods yet and there needs to be further sustainable activity to be convincing. A cloud of uncertainty remains, given the sector's hit and miss performance so far this year and lower than average business confidence in June."

Mark Robinson, Chief Executive of Scape Group, said the key to maintaining the sector's positive momentum is gaining clarity over the Government's Brexit policy, "to bolster confidence and provide certainty for the construction industry and the wider economy".

"Big-ticket infrastructure projects like Heathrow's expansion are also crucial to ensuring the UK remains an infrastructure leader on the world stage and will help secure our position post-Brexit," he said.

"However, as last week's vote shows, these critical infrastructure projects have become far too politicised in recent years. Infrastructure improvements across the UK from new high-speed rail lines to local road improvements are pivotal to maintaining a buoyant and productive economy that is attractive to foreign direct investment.

"With new work comes the need for more people on the ground. Construction companies must prioritise upskilling and training to build long-term capacity, with the support of government, and the industry must also raise its game in terms of innovative and new technologies in order to attract the next generation of workers to the sector."

(LM/MH)

The seasonally adjusted IHS Markit/CIPS UK Construction Purchasing Managers' Index (PMI) posted 53.1 in June, up from 52.5 in May and above the 50.0 no-change value for the third month running.

With the latest reading pointing to the sharpest overall rise in output since November 2017, the increase marks three months of sustained recovery following the snow-related disruption experienced in March.

Residential works remained the best performing area, while commercial building also contributed to the stronger overall rise in construction output, expanding at its fastest pace since February. Yet, civil engineering activity rose only slightly in June, with the rate of growth easing to a three-month low.

Firms noted that a general improvement in client demand had helped to boost construction workloads in June, with figures indicating a solid rebound in new order volumes following the decline seen during the previous month. The rate of new business growth was the strongest for just over one year in June.

In addition, higher levels of new work contributed to faster increases in employment numbers and purchasing activity during June. The rate of job creation accelerated to its strongest for one year, while the latest rise in input buying was the steepest since December 2015. Survey respondents noted that greater purchasing activity reflected new projects starts and, in some cases, forward purchasing of inputs to mitigate forthcoming price rises from suppliers.

Elsewhere, average cost burdens increased at a share and accelerated pace in June, with the latest rise in input prices being its steepest for nine months. Respondents attributed this to greater transportation costs and higher prices for metals (especially steel). Meanwhile, vendor lead times lengthened again in June, driven by low stocks and capacity constraints among suppliers.

On the sector's future outlook, companies indicated a rebound in business optimism from May's seven-month low, although the degree of positive sentiment remained much weaker than the long-run survey average. Overall, firms cited infrastructure work as a key source of growth in the coming 12 months.

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said: "With the fastest rise in new orders since May 2017, it appears the brakes are off for the construction sector. Despite being hampered by economic uncertainty, firms reported an improved pipeline of work as clients committed to projects and hesitancy was swept away.

"Input prices were a challenge with the biggest inflationary rise since September 2017, so the pressure was on to build up stocks of materials rising in price and becoming more scarce. This resulted in a heavy impact on suppliers unable to keep pace as deliveries became laboured and purchasing managers were at their busiest for two and a half years.

"Housing continued on its positive trajectory for a fifth month and commercial activity also improved after a weak start to the second quarter. However, before we bring out the bunting, the sector is not out of the woods yet and there needs to be further sustainable activity to be convincing. A cloud of uncertainty remains, given the sector's hit and miss performance so far this year and lower than average business confidence in June."

Mark Robinson, Chief Executive of Scape Group, said the key to maintaining the sector's positive momentum is gaining clarity over the Government's Brexit policy, "to bolster confidence and provide certainty for the construction industry and the wider economy".

"Big-ticket infrastructure projects like Heathrow's expansion are also crucial to ensuring the UK remains an infrastructure leader on the world stage and will help secure our position post-Brexit," he said.

"However, as last week's vote shows, these critical infrastructure projects have become far too politicised in recent years. Infrastructure improvements across the UK from new high-speed rail lines to local road improvements are pivotal to maintaining a buoyant and productive economy that is attractive to foreign direct investment.

"With new work comes the need for more people on the ground. Construction companies must prioritise upskilling and training to build long-term capacity, with the support of government, and the industry must also raise its game in terms of innovative and new technologies in order to attract the next generation of workers to the sector."

(LM/MH)

29/01/2025

Caddick Construction has been awarded a £43 million contract to deliver the first phase of Cole Waterhouse's flagship regeneration scheme in Digbeth, Birmingham.

The project, known as Upper Trinity Street, marks a significant step in the area’s transformation.

Spanning 182,986 square feet, the re

29/01/2025

McLaren Construction has been appointed by O&H Properties to deliver the first phase of a £60 million Foster & Partners-designed development at the corner of New Bond Street and Grafton Street in London’s West End.

The seven-storey, 5,400 square metre prime retail and office scheme will feature ret

29/01/2025

GMI Construction Group has been awarded a contract to develop three high-specification warehouse units totalling over 175,000 square feet at Precedent Drive, Milton Keynes.

The £20 million project, commissioned by DV5 Last Mile Developments (UK) Ltd, a joint venture between Coltham and Delancey Re

29/01/2025

Plans for 106 sustainable new homes in Southville, a neighbourhood in South Bristol, have been approved as the city seeks to increase housing delivery to address growing demand.

Top 10 award-winning housebuilder The Hill Group will create a £60 million development on Raleigh Road, on land that was

29/01/2025

Bouygues UK has reached a major milestone in the fourth phase of the Hallsville Quarter regeneration project in Canning Town, London.

The project, part of the £3.7 billion Canning Town and Custom House Regeneration Programme, recently held a topping out ceremony, marking the completion of the 11-s

29/01/2025

Willmott Dixon Interiors is carrying out a significant upgrade to the roof of the National Maritime Museum in Greenwich, one of London's most iconic cultural landmarks.

As part of the £12 million project, the company is installing over 23,000 square feet of sun-protected glazing above the museum’s

29/01/2025

Equans has been appointed by Babergh and Mid Suffolk District Councils to carry out crucial decarbonisation work across the councils' housing stock, using funding secured through the Social Housing Decarbonisation Fund (SHDF).

The councils used the South East Consortium's Zero Carbon Framework to s

29/01/2025

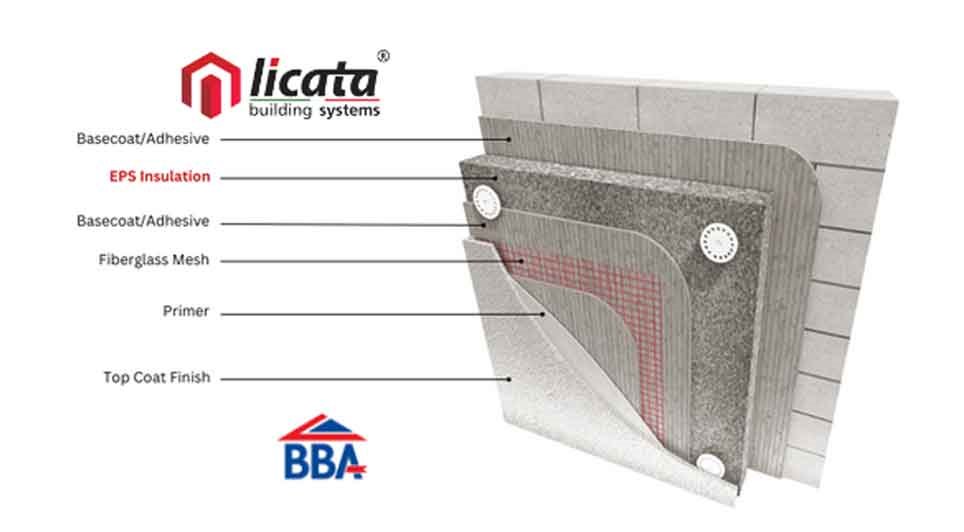

In the world of construction, the quest for energy efficiency and sustainability is ever-evolving. Among the array of solutions available, EPS (Expanded Polystyrene) insulation stands out as a versatile and effective option for enhancing the thermal performance of buildings, particularly when used f

29/01/2025

BCP Council has completed significant coastal protection works at Hamworthy Park, ensuring its resilience against erosion for the next 20 years.

A 200-metre stretch of sea wall along the eastern promenade has been reinforced using low-carbon concrete, while new steps have been constructed to improv

29/01/2025

Geo-environmental consultancy and remediation contractor, The LK Group, has strengthened its team with a trio of recruits.

The multidisciplinary company's latest raft of hires comprises a new director, associate director and remediation manager.

The geo-environmental specialist, headquartered i

UK

UK Ireland

Ireland Scotland

Scotland London

London