Unpaid invoices can affect the balance sheets of construction businesses small and large. Roan Hay of debt collection agency Redwood Collections gives his views on the issue.

It is a sad fact of the construction industry that non-payment of invoices is an acknowledged recurring problem. This can particularly be the case for independent firms. Cases frequently involve issues further up or down the contract chain causing a knock-on effect, often with complicated contractual issues causing your customers to point their finger elsewhere. For you, the company out of pocket, this point of view is of course completely unreasonable. The bill should simply be paid, and the dispute sorted out among the other parties. After all, your company has carried out the job expertly and professionally and you are entitled to timely payment in return.

• THE CURRENT SOLUTION

When all efforts to mediate, grant further time or perhaps even arrange payment over a few instalments have failed, you may look to the court system to try and enforce the now overdue debt. We have found that many of our construction industry clients have grown frustrated at the length of time a typical County Court action can take. Having tight paper trails, concise documentation and properly signed and completed agreements by all parties can go some way towards strengthening the case, but winning judgment in your favour is often the easy part. The process will often be slowed down with the myriad of excuses a defendant can throw at the system to deter the creditor, including spurious defences, adjournments, multiple court attendances and then a high volume of enforcement failures. Now another factor is the little-known but very important Pre-Action Protocol for Debt Claims which came into force in October 2017, making it more time-consuming to take debtors to court. If a county court judgment (CCJ) is obtained, you may find that court bailiffs possess little incentive to recover money from the debtor, their efforts usually resulting in an all-too-easy application being made to waive the bailiff's warrant and pay the debt via instalments at a derisory rate. Privately run firms of High Court Enforcement Officers may return better result, but the reality is less effective than television shows may lead you to believe. In other words, despite all this still no money is collected, and further money is wasted in the chase.

• ANOTHER WAY

Outsourcing your credit control can take away the hassle of constantly chasing the same customers again and again, granting more time to focus on business development and other important factors. More often than not, an experienced debt recovery agency (DCA) can arrange payment in full, an amicable settlement or an agreeable repayment plan without recourse to law. At Redwood Collections our approach is to engage the debtor in dignified and constructive discussion from the outset. This puts an intermediary between you and your customers and helps to eliminate invalid reasons for non-payment. In many cases, we are able to resolve issues and recover debt immediately or arrange instalment plans designed to suit both parties. One good telephone call from an experienced collector can be worth more than a handful of letters or a premature legal action. An authorised DCA (regulated by the Financial Conduct Authority) will know the regulations for appropriate contact with debtors and can therefore operate outside normal working hours to maximum the opportunity for contact.

• WHAT ABOUT STUBBORN DEBTORS?

In persistent cases there is an alternative approach to the County Court to achieve maximum value for money when issuing legal action. We continue to see great success with county court claims but sadly it seems the stigma that was once associated with the burden of carrying a CCJ has waned slightly. For those customers out there, who seemingly work hard to avoid their responsibilities, the service of a Statutory Demand, issued in accordance with the Insolvency Act 1986, could prove a very effective step. This is the initial stage towards the Winding-up of a business or the bankruptcy of an individual or sole trader. Unlike a County Court Claim, this document does not invite debtors to make soft offers of repayment, neither does it openly invite disputes or require a Court attendance by your firm or a solicitor on your behalf. Providing the case meets stringent criteria and minimum debt amount (£5,000 for an individual/sole trader, or £750 for a company), you are entitled to instigate the service of this precursor notice of an intended petition. The effect can be extremely stark as the implications mean the debtor/company assets and credit worthiness are potentially brought into doubt.

• RECOVERING YOUR COSTS

Any costs associated with legal action or referring the debt to a DCA may be reclaimed if covered in your contractual terms, or under the Late Payment of Commercial Debt (Interest) Act 1998. With the appropriate wording being introduced into your contractual terms and conditions, any reasonable third-party collection costs, howsoever incurred, may be reclaimed from your debtor, pre or post legal action. An experienced DCA will be able to draft a suitable clause for insertion into your terms. Indeed, this is a service Redwood Collections has provided for some years. Firms may also wish to seek guidance from their industry bodies in this regard, as they often keep template terms & conditions for members to use.

If construction firms are armed with modern credit control tools and an up-to-date knowledge, a great deal of hassle and money can be saved down the line, in terms of both prevention and recovery of unpaid debt.

Roan Hay is a senior sales executive at Redwood Collections Ltd.. He can be contacted at rhay@redwoodcollections.com or 020 8288 3503 if you need any assistance in the recovery of unpaid invoices.

www.redwoodcollections.com/refer

Construction News

30/08/2019

Debt Recovery Solution For The Construction Industry

08/04/2025

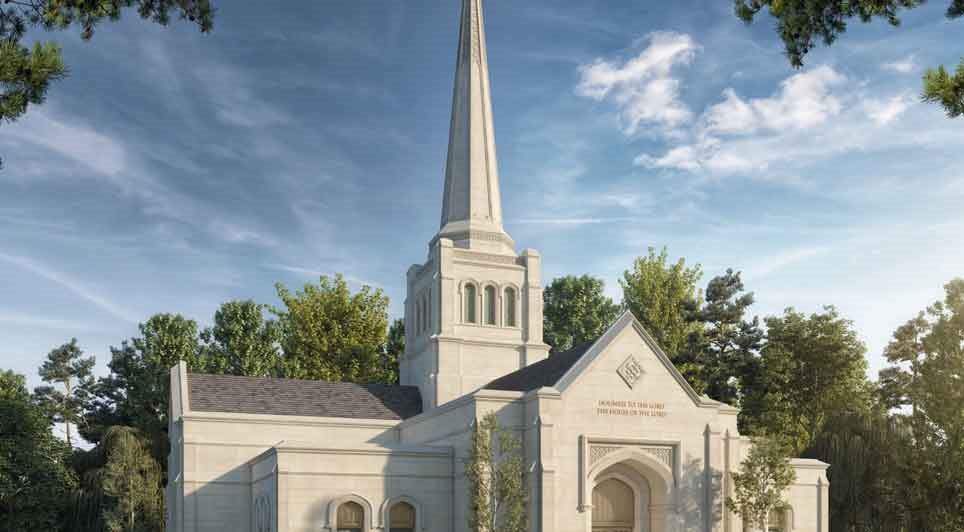

McLaren Construction Midlands and North has officially announced its role in delivering the highly anticipated Birmingham England Temple for The Church of Jesus Christ of Latter-day Saints.

The project commenced with a ceremonial groundbreaking, attended by over 300 guests and live-streamed globall

08/04/2025

The University of Warwick's vision to create world-leading STEM facilities has taken a major step forward with the appointment of Kier as the preferred lead contractor to deliver Phase 1 of its STEM Connect Programme.

The announcement marks a significant milestone in the University's wider Connect

08/04/2025

Building work has officially commenced on a new Football Foundation PlayZone in Southwick.

The new multi-sport pitch is designed to offer football and basketball opportunities to people of all ages and abilities.

The development of the PlayZone has been made possible through a £198,076 grant from

08/04/2025

Avant Homes has announced the acquisition of a 20.1-acre site in Yaddlethorpe and received planning permission to deliver a new £45 million residential development including 200 homes.

Named Moorwell Meadows, the new development will be located off Scotter Road South and will feature a variety of t

08/04/2025

Applebridge Geoenvironmental, part of the Applebridge Family Construction Group, has been appointed for the Severn Trent Water & Hafren Dyfrdwy Ground Investigation Framework.

The framework, valued at £36 million over a three-year period, brings together 12 contractors to undertake vital ground inv

08/04/2025

When business is booming and demand is on the rise, your warehouse's production capacity can start to feel the strain.

While some companies might consider relocating or expanding their premises, there's a smarter solution that doesn't involve moving out—move up instead.

08/04/2025

Fibre cement is a versatile and robust building material that has gained popularity among the construction industry in recent years due to its strength, durability, and low maintenance qualities.

Fibre cement is made from a mixture of cement, cellulose fibres, sand, and other additives that are co

08/04/2025

Peabody's regeneration of South Thamesmead has reached a major milestone, with a topping out ceremony held to celebrate the latest phase of the transformation.

The event marked the progress of Phase Two of Peabody's seven-phase masterplan, a joint venture with housebuilder Lovell, which will delive

07/04/2025

GRAHAM has secured a partnership contract with Solihull Council for the delivery of hard facilities management (FM) services under the established Property Services and Maintenance Partnership.

The new agreement, awarded after a competitive procurement process, extends a relationship with Solihull

07/04/2025

Fleete has started construction on what is believed to be the largest dedicated commercial vehicle electric charging hub in the UK.

The shared facility, located in the Port of Tilbury, is on track for completion in December 2025.

The project marks the first works funded by the UK Government under

UK

UK Ireland

Ireland Scotland

Scotland London

London