Construction News

12/12/2019

Keller Announce New CEO And Strategy Update

Keller Group has announced the appointment of their new CEO alongside the publication of a new strategy update.

Interim CEO and formerly CFO, Michael Speakman, has been announced as the firms new permanent CEO, with immediate effect.

While making the announcement, the Group said that performance for 2019 is expected to be in line with market expectations. All of the significant claims required to deliver this result have now been resolved. The scope adjustment to the Bencor long-term contract has been agreed satisfactorily subject to signed documentation and will be settled in early 2020. Fourth quarter cash flows have continued strongly and, with continued momentum through December, year-end net debt/EBITDA is expected to be at or below 1.5x (on an IAS17 basis) in accordance with the target we set in March of this year.

The Board also announces that it has undertaken a review of the group's strategy and as a consequence has defined more clearly the core activities of its business. Keller will concentrate on being the preferred international geotechnical specialist contractor operating in selected sustainable markets where we enjoy leading positions, and large attractive projects. Local businesses will leverage the group's scale and expertise to deliver engineered solutions and operational excellence, driving market share leadership in our selected segments. Our objective is for Keller to become a more focused, higher quality business with industry leading margins, achieving both sustainable operational delivery and cash generation.

This enhancement and greater focus of Keller's strategy will result in the group rationalising its geographic presence and exiting certain non-core services. We will concentrate our resources on those markets and activities where customers value our skills and expertise to achieve mutual benefits including an appropriate level of financial return.

During 2019 we have very successfully re-focused and restructured our APAC division, which will return to profit for the full year. In order to concentrate more heavily on our higher quality European businesses within our EMEA division, we will make a phased withdrawal from South America, where market conditions remain challenging. We have also commenced a strategic review of our Franki Africa activities, which we expect to be completed by the end of the first quarter of 2020. In North America, the reorganisation and rebranding of our foundation businesses is progressing well, with the new structure becoming effective from 1 January 2020 as planned. We have now refined our initial assessment of the incremental benefit of being able to offer all products and services across North America and anticipate generating materially improved financial performance by 2022 in addition to the cost and efficiency savings previously announced.

The Board recognises the importance of returns to our shareholders. Keller has consistently and materially grown its dividend in the 25 years since listing. Keller has strong cash generation and a robust balance sheet, which together support our ability to continue to increase the dividend sustainably through the market cycle.

This strong cash flow has again been demonstrated by our deleveraging in the second half of 2019. Net debt/EBITDA is expected to be at or below 1.5x (on an IAS17 basis).

The Board is committed to maintaining an efficient balance sheet and regularly reviews the group's capital resources in light of the medium-term investment requirements of the business and will return excess capital to shareholders if and when appropriate. The Board confirms today that it intends to maintain the current progressive dividend policy. In addition to the normal 5% increase to the annual ordinary dividend of recent years, the Board now intends to declare a non-recurring supplementary dividend of 2.3 pence per share for 2019 and of 4.4 pence per share for 2020, to bring the total full year dividend to 40 pence per share and 44 pence per share for 2019 and 2020 respectively.

Michael Speakman, Chief Executive Officer, said: "The Board expects the group's performance for 2019 to be in line with market expectations. I am delighted that following the focused restructuring actions delivered by local management in APAC, the division will return to full year profit in 2019. We are also on track to deliver our net debt/EBITDA target of at or below 1.5x.

"The newly enhanced strategy provides greater clarity and creates exciting opportunities to grow shareholder value significantly in the coming years. The Board's decision to return excess capital to shareholders in the form of supplementary dividends for the financial years 2019 and 2020 evidences the Board's confidence in the group's prospects."

Interim CEO and formerly CFO, Michael Speakman, has been announced as the firms new permanent CEO, with immediate effect.

While making the announcement, the Group said that performance for 2019 is expected to be in line with market expectations. All of the significant claims required to deliver this result have now been resolved. The scope adjustment to the Bencor long-term contract has been agreed satisfactorily subject to signed documentation and will be settled in early 2020. Fourth quarter cash flows have continued strongly and, with continued momentum through December, year-end net debt/EBITDA is expected to be at or below 1.5x (on an IAS17 basis) in accordance with the target we set in March of this year.

The Board also announces that it has undertaken a review of the group's strategy and as a consequence has defined more clearly the core activities of its business. Keller will concentrate on being the preferred international geotechnical specialist contractor operating in selected sustainable markets where we enjoy leading positions, and large attractive projects. Local businesses will leverage the group's scale and expertise to deliver engineered solutions and operational excellence, driving market share leadership in our selected segments. Our objective is for Keller to become a more focused, higher quality business with industry leading margins, achieving both sustainable operational delivery and cash generation.

This enhancement and greater focus of Keller's strategy will result in the group rationalising its geographic presence and exiting certain non-core services. We will concentrate our resources on those markets and activities where customers value our skills and expertise to achieve mutual benefits including an appropriate level of financial return.

During 2019 we have very successfully re-focused and restructured our APAC division, which will return to profit for the full year. In order to concentrate more heavily on our higher quality European businesses within our EMEA division, we will make a phased withdrawal from South America, where market conditions remain challenging. We have also commenced a strategic review of our Franki Africa activities, which we expect to be completed by the end of the first quarter of 2020. In North America, the reorganisation and rebranding of our foundation businesses is progressing well, with the new structure becoming effective from 1 January 2020 as planned. We have now refined our initial assessment of the incremental benefit of being able to offer all products and services across North America and anticipate generating materially improved financial performance by 2022 in addition to the cost and efficiency savings previously announced.

The Board recognises the importance of returns to our shareholders. Keller has consistently and materially grown its dividend in the 25 years since listing. Keller has strong cash generation and a robust balance sheet, which together support our ability to continue to increase the dividend sustainably through the market cycle.

This strong cash flow has again been demonstrated by our deleveraging in the second half of 2019. Net debt/EBITDA is expected to be at or below 1.5x (on an IAS17 basis).

The Board is committed to maintaining an efficient balance sheet and regularly reviews the group's capital resources in light of the medium-term investment requirements of the business and will return excess capital to shareholders if and when appropriate. The Board confirms today that it intends to maintain the current progressive dividend policy. In addition to the normal 5% increase to the annual ordinary dividend of recent years, the Board now intends to declare a non-recurring supplementary dividend of 2.3 pence per share for 2019 and of 4.4 pence per share for 2020, to bring the total full year dividend to 40 pence per share and 44 pence per share for 2019 and 2020 respectively.

Michael Speakman, Chief Executive Officer, said: "The Board expects the group's performance for 2019 to be in line with market expectations. I am delighted that following the focused restructuring actions delivered by local management in APAC, the division will return to full year profit in 2019. We are also on track to deliver our net debt/EBITDA target of at or below 1.5x.

"The newly enhanced strategy provides greater clarity and creates exciting opportunities to grow shareholder value significantly in the coming years. The Board's decision to return excess capital to shareholders in the form of supplementary dividends for the financial years 2019 and 2020 evidences the Board's confidence in the group's prospects."

29/01/2025

Caddick Construction has been awarded a £43 million contract to deliver the first phase of Cole Waterhouse's flagship regeneration scheme in Digbeth, Birmingham.

The project, known as Upper Trinity Street, marks a significant step in the area’s transformation.

Spanning 182,986 square feet, the re

29/01/2025

McLaren Construction has been appointed by O&H Properties to deliver the first phase of a £60 million Foster & Partners-designed development at the corner of New Bond Street and Grafton Street in London’s West End.

The seven-storey, 5,400 square metre prime retail and office scheme will feature ret

29/01/2025

GMI Construction Group has been awarded a contract to develop three high-specification warehouse units totalling over 175,000 square feet at Precedent Drive, Milton Keynes.

The £20 million project, commissioned by DV5 Last Mile Developments (UK) Ltd, a joint venture between Coltham and Delancey Re

29/01/2025

Plans for 106 sustainable new homes in Southville, a neighbourhood in South Bristol, have been approved as the city seeks to increase housing delivery to address growing demand.

Top 10 award-winning housebuilder The Hill Group will create a £60 million development on Raleigh Road, on land that was

29/01/2025

Bouygues UK has reached a major milestone in the fourth phase of the Hallsville Quarter regeneration project in Canning Town, London.

The project, part of the £3.7 billion Canning Town and Custom House Regeneration Programme, recently held a topping out ceremony, marking the completion of the 11-s

29/01/2025

Willmott Dixon Interiors is carrying out a significant upgrade to the roof of the National Maritime Museum in Greenwich, one of London's most iconic cultural landmarks.

As part of the £12 million project, the company is installing over 23,000 square feet of sun-protected glazing above the museum’s

29/01/2025

Equans has been appointed by Babergh and Mid Suffolk District Councils to carry out crucial decarbonisation work across the councils' housing stock, using funding secured through the Social Housing Decarbonisation Fund (SHDF).

The councils used the South East Consortium's Zero Carbon Framework to s

29/01/2025

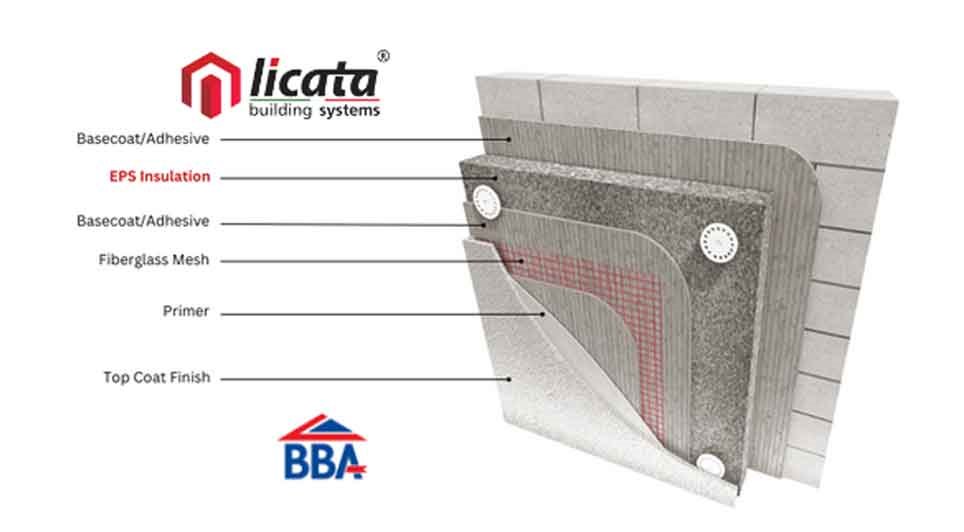

In the world of construction, the quest for energy efficiency and sustainability is ever-evolving. Among the array of solutions available, EPS (Expanded Polystyrene) insulation stands out as a versatile and effective option for enhancing the thermal performance of buildings, particularly when used f

29/01/2025

BCP Council has completed significant coastal protection works at Hamworthy Park, ensuring its resilience against erosion for the next 20 years.

A 200-metre stretch of sea wall along the eastern promenade has been reinforced using low-carbon concrete, while new steps have been constructed to improv

29/01/2025

Geo-environmental consultancy and remediation contractor, The LK Group, has strengthened its team with a trio of recruits.

The multidisciplinary company's latest raft of hires comprises a new director, associate director and remediation manager.

The geo-environmental specialist, headquartered i

UK

UK Ireland

Ireland Scotland

Scotland London

London