Construction News

17/01/2024

Industry Suppliers To Go From 'Strength To Strength' In 2024

Suppliers to the building and construction industry are set to go from strength to strength in 2024, according to a new report.

Small and medium-sized firms in the sector achieved a score of 82 out of 100 in the latest Manufacturers' Health Index, compiled quarterly by inventory software brand Unleashed.

The index is calculated from a number of key performance metrics including sales, purchasing, and internal efficiencies that impact stocking levels and lead times across 16 manufacturing categories. A score of 50 points or more indicates that a sector is performing well against these metrics.

Jarrod Adam, Head of Product at Unleashed, said: "Manufacturers in every industry category were hit by challenges from all directions in 2023 – including high inflation and rising borrowing costs.

"The UK is home to over 98,000 construction companies, many of which are SMEs that make a critical contribution to both the industry and the UK economy.

"It's clear from our index that firms have recovered well from the supply chain disruption – and high cost of materials – seen during the pandemic and its aftermath. The tough economic climate doesn't appear to have dampened homeowners' appetite for renovations because they recognise the long-term value they can have.

"Our index also shows that lead times have dropped for building and construction, down to 17 days – below the national average of 20. However, the industry is facing high overstock levels at £364,502 – the highest of any industry, and well over double the average level of £141,397. This reflects the slowdown in bigger house building projects due to high borrowing costs and economic uncertainty."

Looking ahead to the coming year, he added: "While the building and construction sector work to overcome costs and reduce their overstock levels, our analysis suggests that they are in a strong position to meet this demand because they have finely-tuned their inventory management processes. Of course, any improvements they make would put them on an even stronger footing in this highly-competitive and fast-moving sector."

• Bigger picture: the haves and have-nots of UK manufacturing

Overall, the UK manufacturing industry rebounded at the end of 2023, with 11 of the 16 categories studied scoring more than 50 health points in the Manufacturers' Health Index – contributing to the average of 77.

Top of the table were cosmetics and personal care, and industrial machinery, raw material and equipment, which both achieved a near-perfect score of 98. Office equipment and supplies was bottom of the table at just 18 points, followed by food at 30 and electronics and communication at 38.

Lead times have also more than halved from the 43 day average of 2022 to 20 at the end of 2023.

However, the legacy of the pandemic is still clear, with 'just in case' overstocking now a fixture for many businesses. In the latter part of the year, excess inventory levels grew to £141,397 compared to £119,183 for the same period in 2022. Retail and consumer-centric manufacturers appear to have a better handle of their inventory compared to heavier industries like building and construction or metal and fabrication where longer lead times are already more typical.

For more information and for the full research, go to www.unleashedsoftware.com/blog/manufacturing-health-index

Small and medium-sized firms in the sector achieved a score of 82 out of 100 in the latest Manufacturers' Health Index, compiled quarterly by inventory software brand Unleashed.

The index is calculated from a number of key performance metrics including sales, purchasing, and internal efficiencies that impact stocking levels and lead times across 16 manufacturing categories. A score of 50 points or more indicates that a sector is performing well against these metrics.

Jarrod Adam, Head of Product at Unleashed, said: "Manufacturers in every industry category were hit by challenges from all directions in 2023 – including high inflation and rising borrowing costs.

"The UK is home to over 98,000 construction companies, many of which are SMEs that make a critical contribution to both the industry and the UK economy.

"It's clear from our index that firms have recovered well from the supply chain disruption – and high cost of materials – seen during the pandemic and its aftermath. The tough economic climate doesn't appear to have dampened homeowners' appetite for renovations because they recognise the long-term value they can have.

"Our index also shows that lead times have dropped for building and construction, down to 17 days – below the national average of 20. However, the industry is facing high overstock levels at £364,502 – the highest of any industry, and well over double the average level of £141,397. This reflects the slowdown in bigger house building projects due to high borrowing costs and economic uncertainty."

Looking ahead to the coming year, he added: "While the building and construction sector work to overcome costs and reduce their overstock levels, our analysis suggests that they are in a strong position to meet this demand because they have finely-tuned their inventory management processes. Of course, any improvements they make would put them on an even stronger footing in this highly-competitive and fast-moving sector."

• Bigger picture: the haves and have-nots of UK manufacturing

Overall, the UK manufacturing industry rebounded at the end of 2023, with 11 of the 16 categories studied scoring more than 50 health points in the Manufacturers' Health Index – contributing to the average of 77.

Top of the table were cosmetics and personal care, and industrial machinery, raw material and equipment, which both achieved a near-perfect score of 98. Office equipment and supplies was bottom of the table at just 18 points, followed by food at 30 and electronics and communication at 38.

Lead times have also more than halved from the 43 day average of 2022 to 20 at the end of 2023.

However, the legacy of the pandemic is still clear, with 'just in case' overstocking now a fixture for many businesses. In the latter part of the year, excess inventory levels grew to £141,397 compared to £119,183 for the same period in 2022. Retail and consumer-centric manufacturers appear to have a better handle of their inventory compared to heavier industries like building and construction or metal and fabrication where longer lead times are already more typical.

For more information and for the full research, go to www.unleashedsoftware.com/blog/manufacturing-health-index

29/01/2025

Caddick Construction has been awarded a £43 million contract to deliver the first phase of Cole Waterhouse's flagship regeneration scheme in Digbeth, Birmingham.

The project, known as Upper Trinity Street, marks a significant step in the area’s transformation.

Spanning 182,986 square feet, the re

29/01/2025

McLaren Construction has been appointed by O&H Properties to deliver the first phase of a £60 million Foster & Partners-designed development at the corner of New Bond Street and Grafton Street in London’s West End.

The seven-storey, 5,400 square metre prime retail and office scheme will feature ret

29/01/2025

GMI Construction Group has been awarded a contract to develop three high-specification warehouse units totalling over 175,000 square feet at Precedent Drive, Milton Keynes.

The £20 million project, commissioned by DV5 Last Mile Developments (UK) Ltd, a joint venture between Coltham and Delancey Re

29/01/2025

Plans for 106 sustainable new homes in Southville, a neighbourhood in South Bristol, have been approved as the city seeks to increase housing delivery to address growing demand.

Top 10 award-winning housebuilder The Hill Group will create a £60 million development on Raleigh Road, on land that was

29/01/2025

Bouygues UK has reached a major milestone in the fourth phase of the Hallsville Quarter regeneration project in Canning Town, London.

The project, part of the £3.7 billion Canning Town and Custom House Regeneration Programme, recently held a topping out ceremony, marking the completion of the 11-s

29/01/2025

Willmott Dixon Interiors is carrying out a significant upgrade to the roof of the National Maritime Museum in Greenwich, one of London's most iconic cultural landmarks.

As part of the £12 million project, the company is installing over 23,000 square feet of sun-protected glazing above the museum’s

29/01/2025

Equans has been appointed by Babergh and Mid Suffolk District Councils to carry out crucial decarbonisation work across the councils' housing stock, using funding secured through the Social Housing Decarbonisation Fund (SHDF).

The councils used the South East Consortium's Zero Carbon Framework to s

29/01/2025

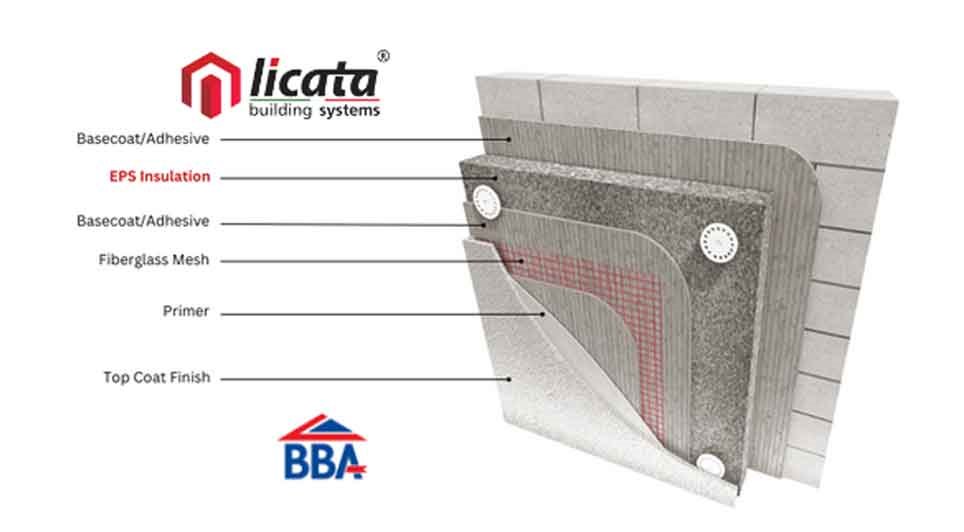

In the world of construction, the quest for energy efficiency and sustainability is ever-evolving. Among the array of solutions available, EPS (Expanded Polystyrene) insulation stands out as a versatile and effective option for enhancing the thermal performance of buildings, particularly when used f

29/01/2025

BCP Council has completed significant coastal protection works at Hamworthy Park, ensuring its resilience against erosion for the next 20 years.

A 200-metre stretch of sea wall along the eastern promenade has been reinforced using low-carbon concrete, while new steps have been constructed to improv

29/01/2025

Geo-environmental consultancy and remediation contractor, The LK Group, has strengthened its team with a trio of recruits.

The multidisciplinary company's latest raft of hires comprises a new director, associate director and remediation manager.

The geo-environmental specialist, headquartered i

UK

UK Ireland

Ireland Scotland

Scotland London

London