Construction News

25/03/2024

What is Asset Finance?

Asset finance is a type of financing that allows businesses to acquire assets such as machinery, equipment, vehicles, or property without having to pay the full purchase price upfront.

It involves obtaining funds from a lender, typically a bank or a specialised finance company, to purchase or lease the asset. The asset itself serves as collateral for the loan, providing security for the lender. The borrower then repays the loan over a fixed period, usually through regular instalments, while having full use and ownership of the asset.

Asset Finance is commonly used by businesses to manage cash flow, acquire necessary assets, and spread the cost of purchases over time.

How can my business benefit from Asset Finance?

Asset finance offers several benefits to businesses. It allows them to acquire necessary assets without tying up a significant amount of capital upfront. This can help improve cash flow and preserve working capital for other business needs. Additionally, asset finance can provide flexibility, as businesses can upgrade or replace assets as needed without the burden of ownership.

What types of asset finance options are available?

Hire Purchase

If you require equipment nance, the most popular way to fund asset purchasing is through hire purchase which will give your business complete ownership of the asset once your agreement is paid in full.

VAT is requested in advance but, subject to status, can be deferred to ease initial cash flow outlay. Terms are flexible from 12-84 months, and both new and used equipment can be considered. Contact us today at Liquid Corporate Finance to discuss how hire purchase could work for your business.

• Fixed payments over terms to suit your business

• Spread the cost over the life of the asset

• Claim capital allowances on the asset you purchase

• Offset interest charges against pre-tax profits

• Take ownership of the asset once payments are complete

Finance Lease

A great way to purchase new equipment or upgrade your existing assets without having to outlay the initial VAT is through finance lease.

VAT will instead be spread across monthly rental instalments. The asset will not show as 'owned' on your balance sheet but instead count as a monthly expense. Like hire purchase, terms from 12-84 months are available, subject to approval. Contact us today at Liquid Corporate Finance if you are seeking equipment finance.

• Low up front outlay as VAT is spread across each monthly payment

• Offset Rentals against pre-tax profits

• Flexible terms and periods can be worked around your cash flow

• VAT may be claimed against monthly rentals

• Options available at the end of the agreement

What assets can be financed?

Asset Finance can be used to finance a wide range of assets, including:

• Vehicles: Cars, trucks, vans, and other types of vehicles can be financed through asset nance. This includes both new and used vehicles.

• Machinery and Equipment: Industrial machinery, manufacturing equipment, construction equipment, agricultural machinery, and other types of equipment can be financed.

• Technology and IT Equipment: Computers, servers, software, telecommunications equipment, office equipment, and other technology assets can be financed.

• Medical Equipment: Hospital beds, MRI machines, X-ray machines, dental equipment, and other medical equipment can be financed through asset finance.

• Commercial Real Estate: Asset finance can be used to finance the purchase or development of commercial properties such as office buildings, retail spaces, warehouses, and factories.

• Renewable Energy Systems: Solar panels, wind turbines, biomass generators, and other renewable energy systems can be financed through asset finance.

• Construction and Infrastructure Projects: Asset finance can be used to finance construction projects, including the purchase of materials, equipment, and machinery.

• Agricultural Assets: Farming equipment, tractors, irrigation systems, and other agricultural assets can be financed.

How flexible is Asset Finance?

Hugely flexible. Due to our extensive network of lenders, we are are able to offer tailored solutions to fit all scenarios, including:

• Vat deferments – Defer your Vat for up three months, allowing you to keep your cash in the bank

• Seasonal payments – Suitable for businesses like farmers, who's earnings fluctuate during seasonal periods

• Step payments – A great option if your business has secured a contract that has a delayed first payment date

The terms and conditions of asset finance agreements, including interest rates, repayment periods, and eligibility criteria, may vary depending on the finance provider and the specific asset being financed. It is important for businesses to carefully consider their needs and compare different options before entering into an asset finance agreement.

If you would like to discuss how our Asset Finance solutions can help fund the growth of your business, contact us via the details below:

Tel: 0333 772 1782

Email: info@liquidcf.co.uk

Visit: www.liquidcf.co.uk

It involves obtaining funds from a lender, typically a bank or a specialised finance company, to purchase or lease the asset. The asset itself serves as collateral for the loan, providing security for the lender. The borrower then repays the loan over a fixed period, usually through regular instalments, while having full use and ownership of the asset.

Asset Finance is commonly used by businesses to manage cash flow, acquire necessary assets, and spread the cost of purchases over time.

How can my business benefit from Asset Finance?

Asset finance offers several benefits to businesses. It allows them to acquire necessary assets without tying up a significant amount of capital upfront. This can help improve cash flow and preserve working capital for other business needs. Additionally, asset finance can provide flexibility, as businesses can upgrade or replace assets as needed without the burden of ownership.

What types of asset finance options are available?

Hire Purchase

If you require equipment nance, the most popular way to fund asset purchasing is through hire purchase which will give your business complete ownership of the asset once your agreement is paid in full.

VAT is requested in advance but, subject to status, can be deferred to ease initial cash flow outlay. Terms are flexible from 12-84 months, and both new and used equipment can be considered. Contact us today at Liquid Corporate Finance to discuss how hire purchase could work for your business.

• Fixed payments over terms to suit your business

• Spread the cost over the life of the asset

• Claim capital allowances on the asset you purchase

• Offset interest charges against pre-tax profits

• Take ownership of the asset once payments are complete

Finance Lease

A great way to purchase new equipment or upgrade your existing assets without having to outlay the initial VAT is through finance lease.

VAT will instead be spread across monthly rental instalments. The asset will not show as 'owned' on your balance sheet but instead count as a monthly expense. Like hire purchase, terms from 12-84 months are available, subject to approval. Contact us today at Liquid Corporate Finance if you are seeking equipment finance.

• Low up front outlay as VAT is spread across each monthly payment

• Offset Rentals against pre-tax profits

• Flexible terms and periods can be worked around your cash flow

• VAT may be claimed against monthly rentals

• Options available at the end of the agreement

What assets can be financed?

Asset Finance can be used to finance a wide range of assets, including:

• Vehicles: Cars, trucks, vans, and other types of vehicles can be financed through asset nance. This includes both new and used vehicles.

• Machinery and Equipment: Industrial machinery, manufacturing equipment, construction equipment, agricultural machinery, and other types of equipment can be financed.

• Technology and IT Equipment: Computers, servers, software, telecommunications equipment, office equipment, and other technology assets can be financed.

• Medical Equipment: Hospital beds, MRI machines, X-ray machines, dental equipment, and other medical equipment can be financed through asset finance.

• Commercial Real Estate: Asset finance can be used to finance the purchase or development of commercial properties such as office buildings, retail spaces, warehouses, and factories.

• Renewable Energy Systems: Solar panels, wind turbines, biomass generators, and other renewable energy systems can be financed through asset finance.

• Construction and Infrastructure Projects: Asset finance can be used to finance construction projects, including the purchase of materials, equipment, and machinery.

• Agricultural Assets: Farming equipment, tractors, irrigation systems, and other agricultural assets can be financed.

How flexible is Asset Finance?

Hugely flexible. Due to our extensive network of lenders, we are are able to offer tailored solutions to fit all scenarios, including:

• Vat deferments – Defer your Vat for up three months, allowing you to keep your cash in the bank

• Seasonal payments – Suitable for businesses like farmers, who's earnings fluctuate during seasonal periods

• Step payments – A great option if your business has secured a contract that has a delayed first payment date

The terms and conditions of asset finance agreements, including interest rates, repayment periods, and eligibility criteria, may vary depending on the finance provider and the specific asset being financed. It is important for businesses to carefully consider their needs and compare different options before entering into an asset finance agreement.

If you would like to discuss how our Asset Finance solutions can help fund the growth of your business, contact us via the details below:

Tel: 0333 772 1782

Email: info@liquidcf.co.uk

Visit: www.liquidcf.co.uk

29/01/2025

Caddick Construction has been awarded a £43 million contract to deliver the first phase of Cole Waterhouse's flagship regeneration scheme in Digbeth, Birmingham.

The project, known as Upper Trinity Street, marks a significant step in the area’s transformation.

Spanning 182,986 square feet, the re

29/01/2025

McLaren Construction has been appointed by O&H Properties to deliver the first phase of a £60 million Foster & Partners-designed development at the corner of New Bond Street and Grafton Street in London’s West End.

The seven-storey, 5,400 square metre prime retail and office scheme will feature ret

29/01/2025

GMI Construction Group has been awarded a contract to develop three high-specification warehouse units totalling over 175,000 square feet at Precedent Drive, Milton Keynes.

The £20 million project, commissioned by DV5 Last Mile Developments (UK) Ltd, a joint venture between Coltham and Delancey Re

29/01/2025

Plans for 106 sustainable new homes in Southville, a neighbourhood in South Bristol, have been approved as the city seeks to increase housing delivery to address growing demand.

Top 10 award-winning housebuilder The Hill Group will create a £60 million development on Raleigh Road, on land that was

29/01/2025

Bouygues UK has reached a major milestone in the fourth phase of the Hallsville Quarter regeneration project in Canning Town, London.

The project, part of the £3.7 billion Canning Town and Custom House Regeneration Programme, recently held a topping out ceremony, marking the completion of the 11-s

29/01/2025

Willmott Dixon Interiors is carrying out a significant upgrade to the roof of the National Maritime Museum in Greenwich, one of London's most iconic cultural landmarks.

As part of the £12 million project, the company is installing over 23,000 square feet of sun-protected glazing above the museum’s

29/01/2025

Equans has been appointed by Babergh and Mid Suffolk District Councils to carry out crucial decarbonisation work across the councils' housing stock, using funding secured through the Social Housing Decarbonisation Fund (SHDF).

The councils used the South East Consortium's Zero Carbon Framework to s

29/01/2025

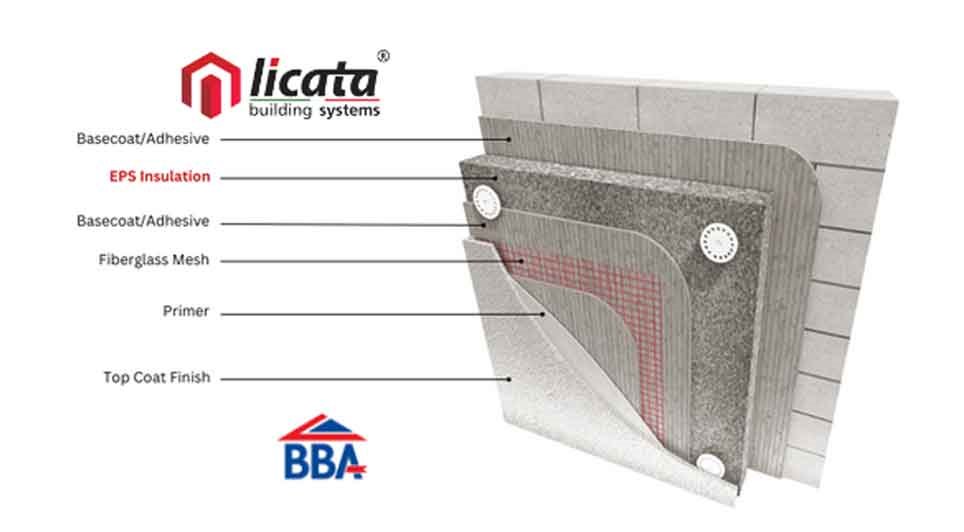

In the world of construction, the quest for energy efficiency and sustainability is ever-evolving. Among the array of solutions available, EPS (Expanded Polystyrene) insulation stands out as a versatile and effective option for enhancing the thermal performance of buildings, particularly when used f

29/01/2025

BCP Council has completed significant coastal protection works at Hamworthy Park, ensuring its resilience against erosion for the next 20 years.

A 200-metre stretch of sea wall along the eastern promenade has been reinforced using low-carbon concrete, while new steps have been constructed to improv

29/01/2025

Geo-environmental consultancy and remediation contractor, The LK Group, has strengthened its team with a trio of recruits.

The multidisciplinary company's latest raft of hires comprises a new director, associate director and remediation manager.

The geo-environmental specialist, headquartered i

UK

UK Ireland

Ireland Scotland

Scotland London

London