Construction News

16/10/2008

VAT Change To Threaten Housing Jobs

The removal of a VAT concession on the wages of temporary housing staff will cost social housing organisations £135m and lead to major job losses at a time when the sector can least afford it, the Recruitment and Employment Confederation (REC) and Procurement for Housing (PfH) have warned.

The Treasury are due to remove the tax concession granted in 1998 to recruitment agencies supplying temporary workers to the social housing, charity, social care and health sectors. The measure, which will take effect next April, means that social landlords will pay VAT on full invoice amounts for temps, rather than just agency commission, a tax that many housing organisations can't reclaim.

In a meeting with HMRC and the Treasury last week, the REC and PfH again called on Government to reconsider removing the tax concession, explaining that the rapidly worsening economic outlook is now really starting to bite in the jobs market with temporary appointments dropping swiftly. At the meeting the REC and PfH explained that with demand for workers declining at its fastest pace since October 2001, it is essential that the Government ensures new measures do not exacerbate the trend.

PfH surveyed its Member housing organisations to measure the impact of imposing VAT on the wages of temporary workers. Over 80% of respondents confirmed that they could not reclaim the tax on all interim staff as they are not VAT registered. Other social landlords reported that they have subsidiaries with charitable status, meaning they are zero rated for VAT purposes, so some temporary workers are tax exempt and others are not.

PfH's survey revealed that each housing association and ALMO estimated they would have to pay an additional£108k per year, a cost of more than £70m to PfH's 650 Members alone. The REC estimates that the overall cost, across all sectors, will be £400m.

The REC is now working with PfH, the Charity Finance Directors Group, English Community Care Association and the Association of Colleges to explore options to mitigate the cost of withdrawing this VAT concession.

(CD/JM)

The Treasury are due to remove the tax concession granted in 1998 to recruitment agencies supplying temporary workers to the social housing, charity, social care and health sectors. The measure, which will take effect next April, means that social landlords will pay VAT on full invoice amounts for temps, rather than just agency commission, a tax that many housing organisations can't reclaim.

In a meeting with HMRC and the Treasury last week, the REC and PfH again called on Government to reconsider removing the tax concession, explaining that the rapidly worsening economic outlook is now really starting to bite in the jobs market with temporary appointments dropping swiftly. At the meeting the REC and PfH explained that with demand for workers declining at its fastest pace since October 2001, it is essential that the Government ensures new measures do not exacerbate the trend.

PfH surveyed its Member housing organisations to measure the impact of imposing VAT on the wages of temporary workers. Over 80% of respondents confirmed that they could not reclaim the tax on all interim staff as they are not VAT registered. Other social landlords reported that they have subsidiaries with charitable status, meaning they are zero rated for VAT purposes, so some temporary workers are tax exempt and others are not.

PfH's survey revealed that each housing association and ALMO estimated they would have to pay an additional£108k per year, a cost of more than £70m to PfH's 650 Members alone. The REC estimates that the overall cost, across all sectors, will be £400m.

The REC is now working with PfH, the Charity Finance Directors Group, English Community Care Association and the Association of Colleges to explore options to mitigate the cost of withdrawing this VAT concession.

(CD/JM)

29/01/2025

Caddick Construction has been awarded a £43 million contract to deliver the first phase of Cole Waterhouse's flagship regeneration scheme in Digbeth, Birmingham.

The project, known as Upper Trinity Street, marks a significant step in the area’s transformation.

Spanning 182,986 square feet, the re

29/01/2025

McLaren Construction has been appointed by O&H Properties to deliver the first phase of a £60 million Foster & Partners-designed development at the corner of New Bond Street and Grafton Street in London’s West End.

The seven-storey, 5,400 square metre prime retail and office scheme will feature ret

29/01/2025

GMI Construction Group has been awarded a contract to develop three high-specification warehouse units totalling over 175,000 square feet at Precedent Drive, Milton Keynes.

The £20 million project, commissioned by DV5 Last Mile Developments (UK) Ltd, a joint venture between Coltham and Delancey Re

29/01/2025

Plans for 106 sustainable new homes in Southville, a neighbourhood in South Bristol, have been approved as the city seeks to increase housing delivery to address growing demand.

Top 10 award-winning housebuilder The Hill Group will create a £60 million development on Raleigh Road, on land that was

29/01/2025

Bouygues UK has reached a major milestone in the fourth phase of the Hallsville Quarter regeneration project in Canning Town, London.

The project, part of the £3.7 billion Canning Town and Custom House Regeneration Programme, recently held a topping out ceremony, marking the completion of the 11-s

29/01/2025

Willmott Dixon Interiors is carrying out a significant upgrade to the roof of the National Maritime Museum in Greenwich, one of London's most iconic cultural landmarks.

As part of the £12 million project, the company is installing over 23,000 square feet of sun-protected glazing above the museum’s

29/01/2025

Equans has been appointed by Babergh and Mid Suffolk District Councils to carry out crucial decarbonisation work across the councils' housing stock, using funding secured through the Social Housing Decarbonisation Fund (SHDF).

The councils used the South East Consortium's Zero Carbon Framework to s

29/01/2025

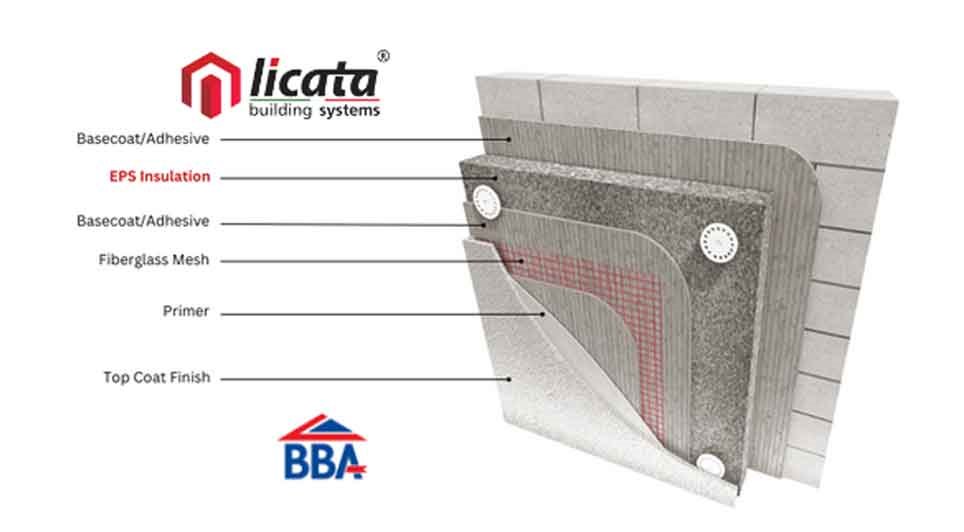

In the world of construction, the quest for energy efficiency and sustainability is ever-evolving. Among the array of solutions available, EPS (Expanded Polystyrene) insulation stands out as a versatile and effective option for enhancing the thermal performance of buildings, particularly when used f

29/01/2025

BCP Council has completed significant coastal protection works at Hamworthy Park, ensuring its resilience against erosion for the next 20 years.

A 200-metre stretch of sea wall along the eastern promenade has been reinforced using low-carbon concrete, while new steps have been constructed to improv

29/01/2025

Geo-environmental consultancy and remediation contractor, The LK Group, has strengthened its team with a trio of recruits.

The multidisciplinary company's latest raft of hires comprises a new director, associate director and remediation manager.

The geo-environmental specialist, headquartered i

UK

UK Ireland

Ireland Scotland

Scotland London

London