Construction News

23/10/2008

CML Publishes New Guidance On Mortgage Arrears

.gif)

The Council of Mortgage Lenders (CML) has published new industry guidance on mortgage arrears and possessions. This will help lenders ensure that their arrears management policies fulfil the objective of making repossession a last resort.

The CML has taken into account feedback from advice agencies to ensure that it balances the interests of consumers and lenders.

The guidance pulls together, and builds on, both the requirements of the FSA's rules in MCOB 13 (which set out how lenders should treat arrears and possessions) and the FSA's "treating customers fairly" principles.

The guidance is a further step in strengthening the robustness of existing practices, alongside the Civil Justice Council's pre-action protocol for court cases on repossession.

The aim of the guidance is to give lenders a practical guide to the requirements, and examples of good practice against which they can benchmark their own policies and procedures. It is not a definitive statement of what lenders "should" do in each case, but rather a reference point to support lenders' self-assessment of their own policies and procedures.

CML Director General Michael Coogan commented: "Despite the fact that the rate of repossession is modest, we recognise that there is significant public concern about this subject. The new guidance should help to reassure consumers that lenders are genuinely committed to seeing repossession as a last resort, and that the checks and balances that protect consumers are in place."

Looking ahead, the CML believes that the changes to Income Support for Mortgage Interest (ISMI) due to take effect next April, which will reduce the initial waiting period on eligible claims from 39 weeks to 13 weeks, will be helpful but should be implemented sooner.

But the CML thinks that even more scope remains for the Government to consider widening ISMI, which at the moment does not help joint-income households where only one borrower loses their income. Individual entitlement, rather than household entitlement, would be an effective and useful change that would help households for whom lack of income, rather than lack of advice or forbearance, is the fundamental problem.

(CD/JM)

The CML has taken into account feedback from advice agencies to ensure that it balances the interests of consumers and lenders.

The guidance pulls together, and builds on, both the requirements of the FSA's rules in MCOB 13 (which set out how lenders should treat arrears and possessions) and the FSA's "treating customers fairly" principles.

The guidance is a further step in strengthening the robustness of existing practices, alongside the Civil Justice Council's pre-action protocol for court cases on repossession.

The aim of the guidance is to give lenders a practical guide to the requirements, and examples of good practice against which they can benchmark their own policies and procedures. It is not a definitive statement of what lenders "should" do in each case, but rather a reference point to support lenders' self-assessment of their own policies and procedures.

CML Director General Michael Coogan commented: "Despite the fact that the rate of repossession is modest, we recognise that there is significant public concern about this subject. The new guidance should help to reassure consumers that lenders are genuinely committed to seeing repossession as a last resort, and that the checks and balances that protect consumers are in place."

Looking ahead, the CML believes that the changes to Income Support for Mortgage Interest (ISMI) due to take effect next April, which will reduce the initial waiting period on eligible claims from 39 weeks to 13 weeks, will be helpful but should be implemented sooner.

But the CML thinks that even more scope remains for the Government to consider widening ISMI, which at the moment does not help joint-income households where only one borrower loses their income. Individual entitlement, rather than household entitlement, would be an effective and useful change that would help households for whom lack of income, rather than lack of advice or forbearance, is the fundamental problem.

(CD/JM)

29/01/2025

Caddick Construction has been awarded a £43 million contract to deliver the first phase of Cole Waterhouse's flagship regeneration scheme in Digbeth, Birmingham.

The project, known as Upper Trinity Street, marks a significant step in the area’s transformation.

Spanning 182,986 square feet, the re

29/01/2025

McLaren Construction has been appointed by O&H Properties to deliver the first phase of a £60 million Foster & Partners-designed development at the corner of New Bond Street and Grafton Street in London’s West End.

The seven-storey, 5,400 square metre prime retail and office scheme will feature ret

29/01/2025

GMI Construction Group has been awarded a contract to develop three high-specification warehouse units totalling over 175,000 square feet at Precedent Drive, Milton Keynes.

The £20 million project, commissioned by DV5 Last Mile Developments (UK) Ltd, a joint venture between Coltham and Delancey Re

29/01/2025

Plans for 106 sustainable new homes in Southville, a neighbourhood in South Bristol, have been approved as the city seeks to increase housing delivery to address growing demand.

Top 10 award-winning housebuilder The Hill Group will create a £60 million development on Raleigh Road, on land that was

29/01/2025

Bouygues UK has reached a major milestone in the fourth phase of the Hallsville Quarter regeneration project in Canning Town, London.

The project, part of the £3.7 billion Canning Town and Custom House Regeneration Programme, recently held a topping out ceremony, marking the completion of the 11-s

29/01/2025

Willmott Dixon Interiors is carrying out a significant upgrade to the roof of the National Maritime Museum in Greenwich, one of London's most iconic cultural landmarks.

As part of the £12 million project, the company is installing over 23,000 square feet of sun-protected glazing above the museum’s

29/01/2025

Equans has been appointed by Babergh and Mid Suffolk District Councils to carry out crucial decarbonisation work across the councils' housing stock, using funding secured through the Social Housing Decarbonisation Fund (SHDF).

The councils used the South East Consortium's Zero Carbon Framework to s

29/01/2025

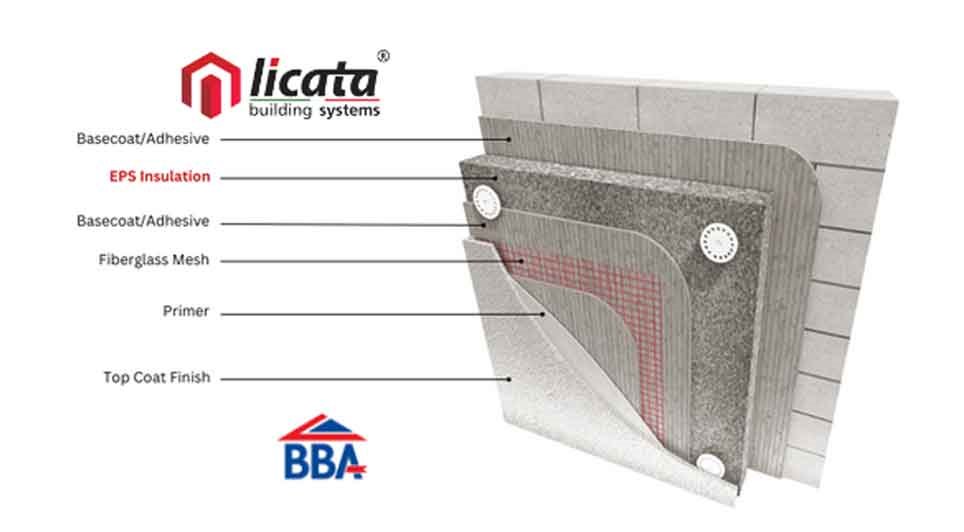

In the world of construction, the quest for energy efficiency and sustainability is ever-evolving. Among the array of solutions available, EPS (Expanded Polystyrene) insulation stands out as a versatile and effective option for enhancing the thermal performance of buildings, particularly when used f

29/01/2025

BCP Council has completed significant coastal protection works at Hamworthy Park, ensuring its resilience against erosion for the next 20 years.

A 200-metre stretch of sea wall along the eastern promenade has been reinforced using low-carbon concrete, while new steps have been constructed to improv

29/01/2025

Geo-environmental consultancy and remediation contractor, The LK Group, has strengthened its team with a trio of recruits.

The multidisciplinary company's latest raft of hires comprises a new director, associate director and remediation manager.

The geo-environmental specialist, headquartered i

UK

UK Ireland

Ireland Scotland

Scotland London

London