Construction News

11/11/2008

Half Of Borrowers Avoid Stamp Duty In September

.gif)

The temporary increase in the stamp duty threshold saw 51% of homebuyers avoiding stamp duty in September, compared with 22% in September last year. However, the number of house purchase loans was 57% lower than September 2007, according to new data from the Council of Mortgage Lenders (CML).

There were 35,000 loans for house purchase worth £5 billion in September, down 15% in volume and 15% in value from August, and less than half September 2007 levels.

There were 62,000 loans for remortgage worth £8.5 billion in September, down 15% in volume and 16% in value from August, but still around two thirds of September 2007 levels.

First-time buyers in September borrowed an average of £104,500, down from £108,000 in August. The amount borrowed has been steadily declining since peaking at £119,250 in July 2007. This has brought the average first-time buyer income multiple down to 3.18, its lowest level since March 2006.

CML Director General, Michael Coogan, said: "While house purchase activity has reached exceptionally low levels, it is encouraging to see transaction costs lowered for a larger proportion of borrowers. The government should consider what other measures can be brought forward to enable the market to transact more easily.

"Banks and building societies do want to support homeowners, but they have limited funds available and are, quite reasonably, taking a prudent approach to risk. If the pricing and volume of interbank lending continues to improve, this should help the flow of mortgage lending."

(CD/JM)

There were 35,000 loans for house purchase worth £5 billion in September, down 15% in volume and 15% in value from August, and less than half September 2007 levels.

There were 62,000 loans for remortgage worth £8.5 billion in September, down 15% in volume and 16% in value from August, but still around two thirds of September 2007 levels.

First-time buyers in September borrowed an average of £104,500, down from £108,000 in August. The amount borrowed has been steadily declining since peaking at £119,250 in July 2007. This has brought the average first-time buyer income multiple down to 3.18, its lowest level since March 2006.

CML Director General, Michael Coogan, said: "While house purchase activity has reached exceptionally low levels, it is encouraging to see transaction costs lowered for a larger proportion of borrowers. The government should consider what other measures can be brought forward to enable the market to transact more easily.

"Banks and building societies do want to support homeowners, but they have limited funds available and are, quite reasonably, taking a prudent approach to risk. If the pricing and volume of interbank lending continues to improve, this should help the flow of mortgage lending."

(CD/JM)

29/01/2025

Caddick Construction has been awarded a £43 million contract to deliver the first phase of Cole Waterhouse's flagship regeneration scheme in Digbeth, Birmingham.

The project, known as Upper Trinity Street, marks a significant step in the area’s transformation.

Spanning 182,986 square feet, the re

29/01/2025

McLaren Construction has been appointed by O&H Properties to deliver the first phase of a £60 million Foster & Partners-designed development at the corner of New Bond Street and Grafton Street in London’s West End.

The seven-storey, 5,400 square metre prime retail and office scheme will feature ret

29/01/2025

GMI Construction Group has been awarded a contract to develop three high-specification warehouse units totalling over 175,000 square feet at Precedent Drive, Milton Keynes.

The £20 million project, commissioned by DV5 Last Mile Developments (UK) Ltd, a joint venture between Coltham and Delancey Re

29/01/2025

Plans for 106 sustainable new homes in Southville, a neighbourhood in South Bristol, have been approved as the city seeks to increase housing delivery to address growing demand.

Top 10 award-winning housebuilder The Hill Group will create a £60 million development on Raleigh Road, on land that was

29/01/2025

Bouygues UK has reached a major milestone in the fourth phase of the Hallsville Quarter regeneration project in Canning Town, London.

The project, part of the £3.7 billion Canning Town and Custom House Regeneration Programme, recently held a topping out ceremony, marking the completion of the 11-s

29/01/2025

Willmott Dixon Interiors is carrying out a significant upgrade to the roof of the National Maritime Museum in Greenwich, one of London's most iconic cultural landmarks.

As part of the £12 million project, the company is installing over 23,000 square feet of sun-protected glazing above the museum’s

29/01/2025

Equans has been appointed by Babergh and Mid Suffolk District Councils to carry out crucial decarbonisation work across the councils' housing stock, using funding secured through the Social Housing Decarbonisation Fund (SHDF).

The councils used the South East Consortium's Zero Carbon Framework to s

29/01/2025

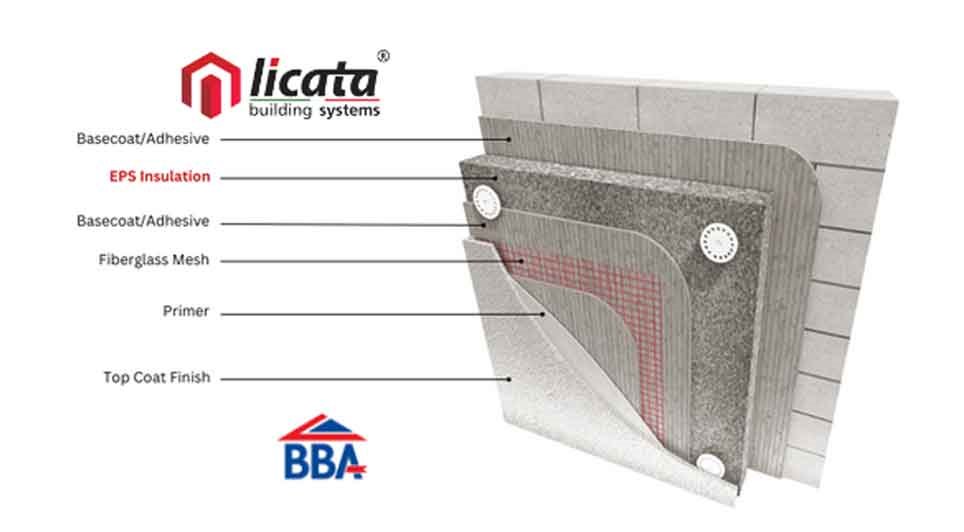

In the world of construction, the quest for energy efficiency and sustainability is ever-evolving. Among the array of solutions available, EPS (Expanded Polystyrene) insulation stands out as a versatile and effective option for enhancing the thermal performance of buildings, particularly when used f

29/01/2025

BCP Council has completed significant coastal protection works at Hamworthy Park, ensuring its resilience against erosion for the next 20 years.

A 200-metre stretch of sea wall along the eastern promenade has been reinforced using low-carbon concrete, while new steps have been constructed to improv

29/01/2025

Geo-environmental consultancy and remediation contractor, The LK Group, has strengthened its team with a trio of recruits.

The multidisciplinary company's latest raft of hires comprises a new director, associate director and remediation manager.

The geo-environmental specialist, headquartered i

UK

UK Ireland

Ireland Scotland

Scotland London

London